In this article

Financial Conversation Confidence

Aqua’s latest survey explores how Brits feel when talking about money, and why they may struggle to discuss financial topics.

Although money can be a sensitive topic for many in the UK, open conversations can make a difference. We found that 88% of people have avoided financial discussions at some point, but they are not alone in their experiences.

To help open up the conversation surrounding finances, we surveyed 2,017 people in the UK to explore who they talk to about tough financial topics and what stops them from sharing their experiences. We also asked what would help people feel more comfortable talking about finances, and partnered with relationship psychologist Mairead Molloy, to provide advice on how to ease into money discussions with friends and loved ones.

Which money topics are the hardest to discuss?

While many people feel comfortable discussing money generally, certain financial topics remain more challenging to navigate. Across the UK, we found that the most difficult topic to talk about is asking for financial help or support, with 26% of respondents identifying this as their biggest challenge. This is particularly common among those aged 25 to 44 (31%), a demographic that may be managing significant financial milestones, such as home ownership or family planning.

For younger adults aged 18 to 24, the most difficult financial conversations revolve around savings and investments, with 24% finding these topics challenging. This period of life often brings new financial experiences, such as starting university or starting a first job, which can introduce unfamiliar money management decisions.

Sharvan Selvam, Commercial Director at Aqua, says: “Navigating personal finances for the first time may feel overwhelming, but open conversations–whether with family, financial advisers, or university support services–can help build confidence and make financial planning feel more manageable.”

We found that debt is another sensitive topic, with nearly a quarter (24%) of UK adults reporting difficulty discussing it. However, whether through student loans, mortgages, or credit cards, borrowing money is a common financial experience. Sharvan adds: “While debt may be a reality for some, the hesitation to talk about it can sometimes prevent people from exploring practical solutions. Open discussions can help individuals feel more informed and in control of their financial decisions.”

Why do people struggle to talk about money?

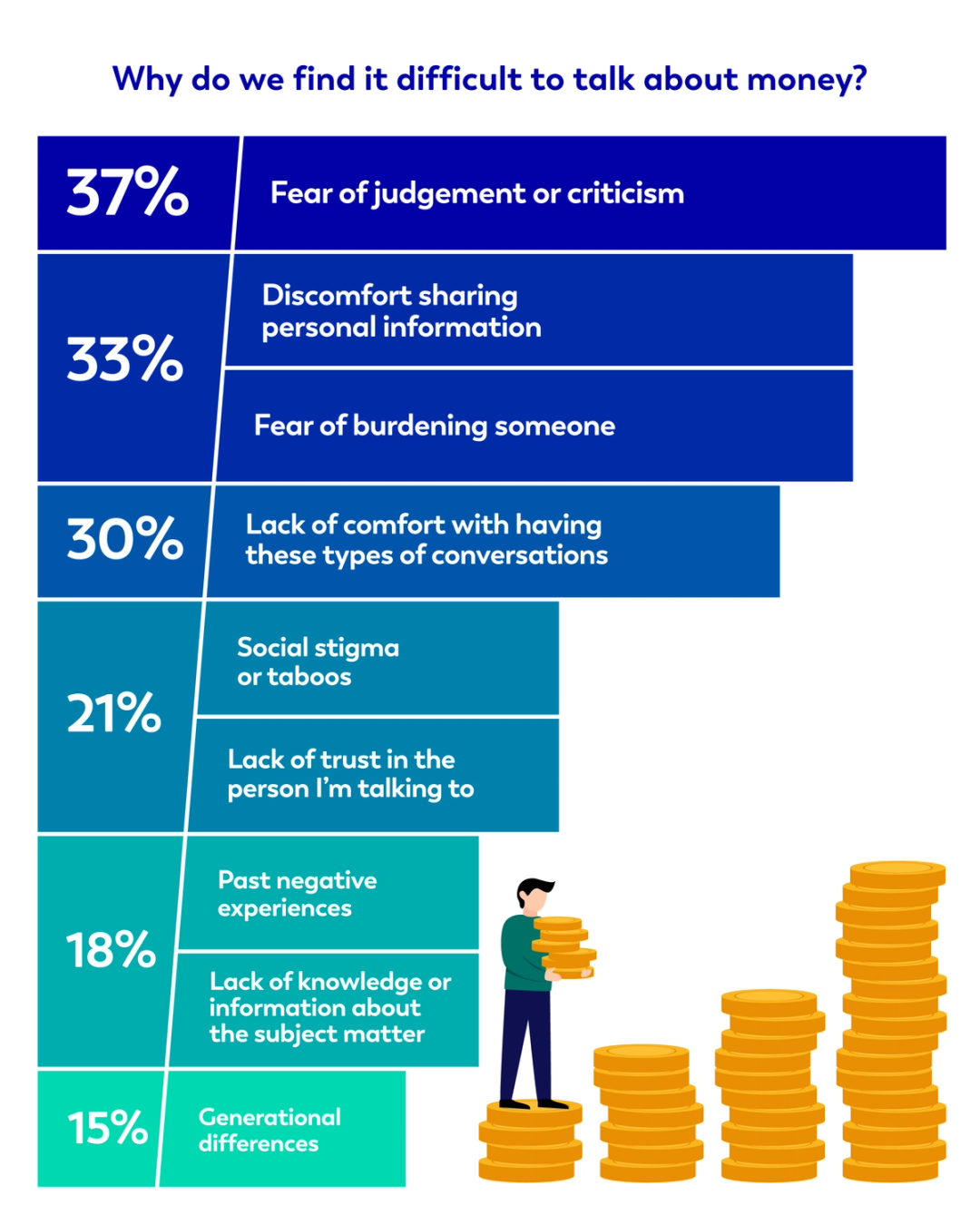

Our survey found that the most common challenge in financial discussions is a fear of judgement or criticism, cited by over a third (37%) of respondents. This highlights the importance of ensuring people have an environment where they feel comfortable talking about money without being concerned about negative reactions.

Concerns about burdening others, and concerns around sharing personal information are also significant barriers, with 33% of respondents identifying these as their primary challenge. Among younger adults, the most prevalent reason for avoiding financial conversations is not wanting to burden others. However, for older adults aged 65+, privacy is their biggest concern, with nearly half (48%) of respondents in this demographic saying so. While vigilance is important, discussing money with trusted individuals can help ensure informed decision-making and financial confidence.

Avoidance of financial conversations altogether is seemingly another trend, with one in 10 adults saying they always steer clear of financial topics. Avoiding money discussions appears to vary by region—Yorkshire and the Humber residents are the most likely to shy away from these conversations (17%), while Londoners are the least likely (only 6%).

Who do we feel comfortable talking to about finances?

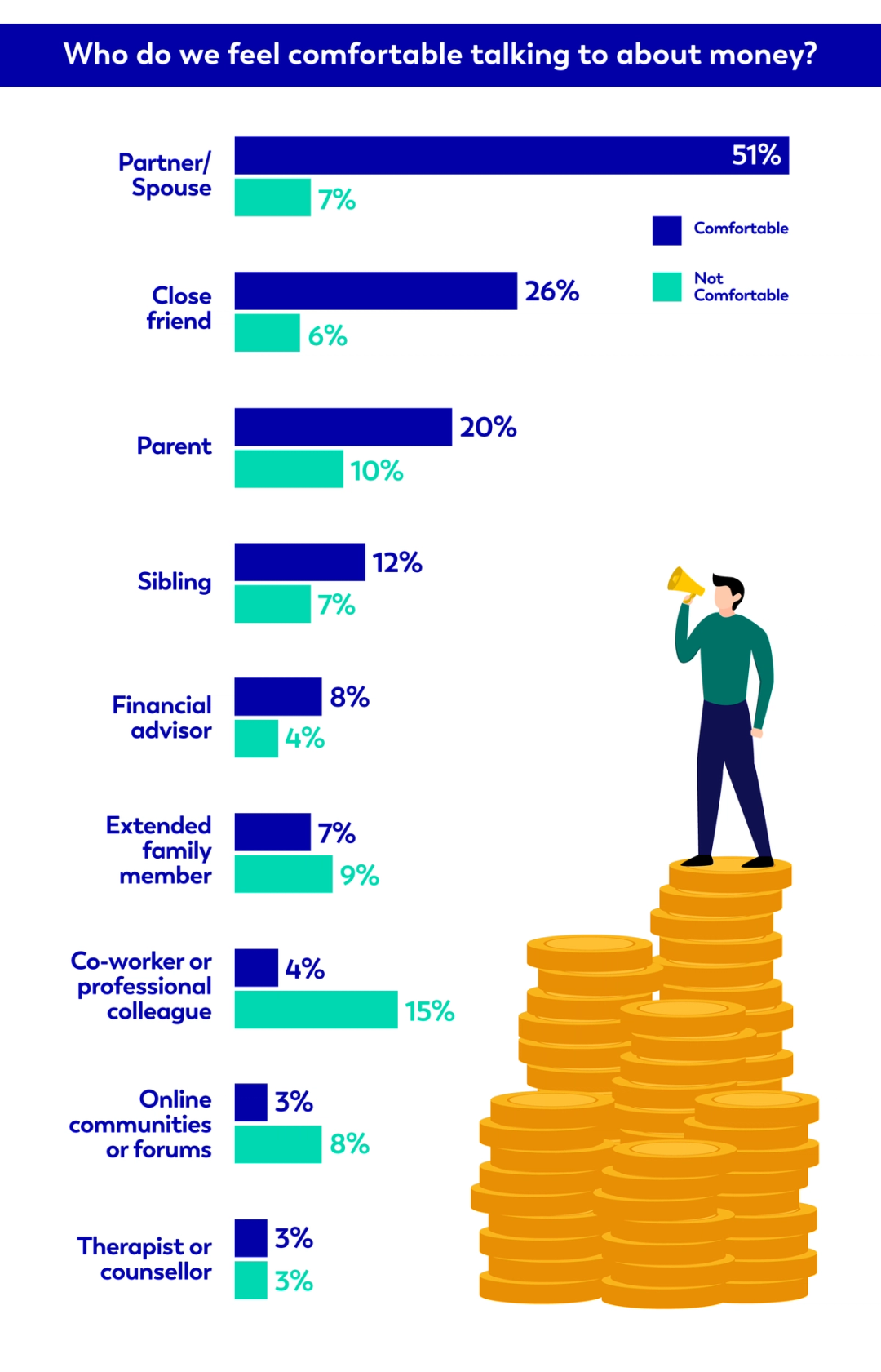

Financial conversations can sometimes feel daunting, but strong relationships that are built on trust can make them easier. Our research found that more than half (51%) of respondents feel more comfortable discussing money with a spouse or partner. However, for a smaller group (7%), a partner is actually the least comfortable person to have these discussions with.

Close friends and parents also serve as a common source of support, with 27% turning to a friend and one fifth (20%) confiding in a parent. While many prefer discussing finances within their immediate circles, some respondents feel more at ease seeking guidance from professionals–8% turn to a financial adviser, and 3% prefer speaking with a therapist.

Not everyone has a specific person they feel uncomfortable discussing money with, but workplaces stand out as one of the more challenging settings. Among respondents, 15% report feeling uneasy talking about finances with a co-worker or colleague. Salary and compensation, in particular, are sensitive topics, with over (12%) finding this especially difficult to discuss. While openness about pay can play a role in workplace transparency, these conversations also bring considerations around professional boundaries and personal privacy. Finding a balance between openness and discretion can help create an environment where financial discussions feel more comfortable, both personally and professionally.

How can we make financial conversations easier?

With Google searches for ‘money help’ increasing by 23% in the past year, it’s evident that many people are actively looking for financial information–often turning to the internet rather than those around them. Encouraging more open, judgement-free discussions about money, both in personal relationships and across wider groups , could help make financial conversations feel more approachable.

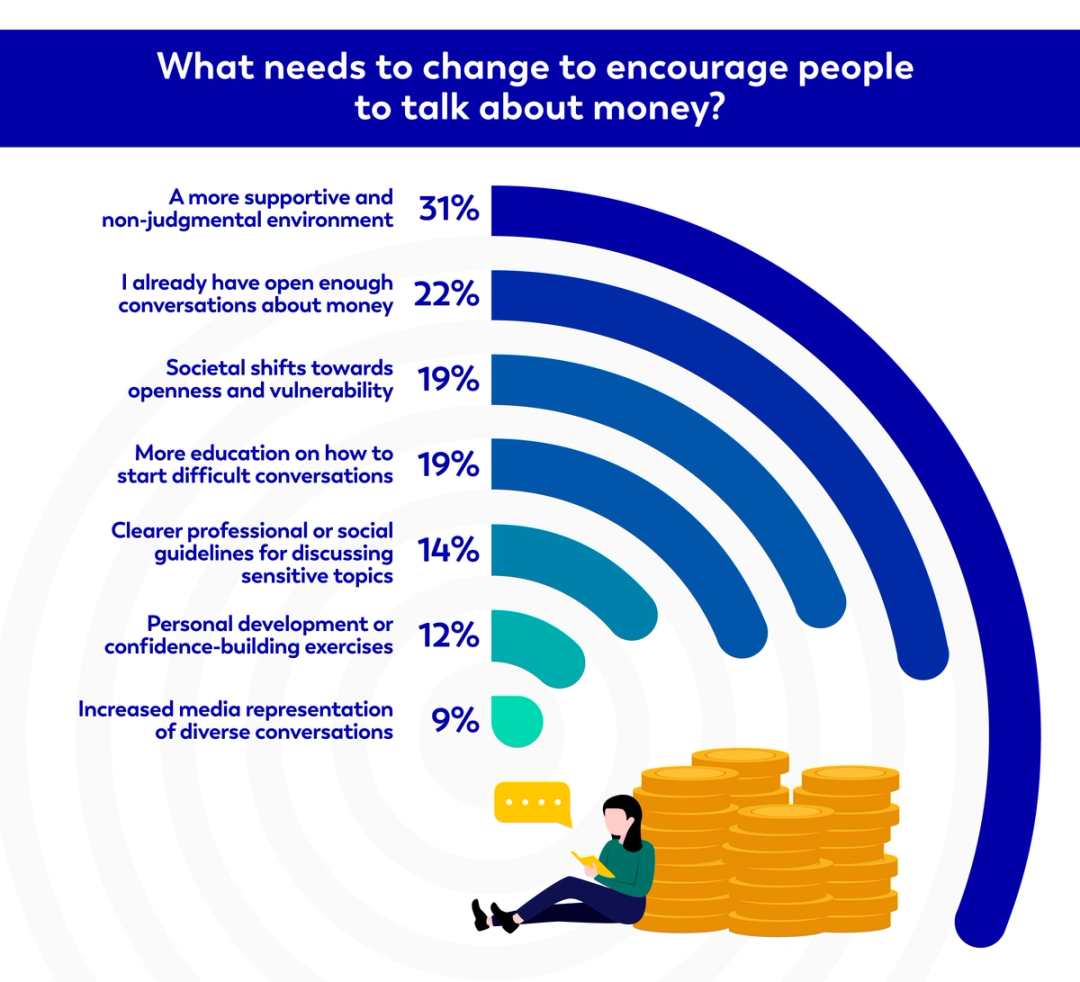

Creating a supportive environment is one of the most significant factors in making money discussions easier, with nearly one third (31%) of respondents saying this would help them feel more comfortable. Among younger adults aged 18 to 24—94% of whom admit to generally avoiding these conversations–32% believe that a judgement-free space would encourage them to talk more openly about finances.

Beyond personal support, some respondents also see value in broader changes. Nearly one fifth (19%) feel that greater societal awareness and education on how to navigate financial discussions would ease discomfort around the topic. As conversations about money become more common, they may feel less intimidating, helping people approach their finances with greater confidence.

Why talking about money matters and how to start difficult financial conversations

Our study shows that while many find financial conversations uncomfortable, creating a non-judgemental environment helps people feel at ease and encourages healthy discussions.

Relationship psychologist Mairead Molloy, who has advised on how couples can best navigate their finances together, gives some actionable advice on how these conversations can help both your mental wellbeing and your finances:

“Money tends to be a big source of stress in relationships, and avoiding the topic can lead to misunderstandings or even resentment over time. Open and honest conversations about finances build trust and help create a sense of partnership. After all, you are supposed to be on the same team.”

To build confidence in these conversations, she suggests several tips:

1. It’s a team effort

Before you start a conversation, it’s useful to approach the discussion with a neutral mindset: "Approach it as a joint effort rather than a confrontation. Being able to discuss financial topics can foster mutual support and deepen your bond. Money can be a tricky topic, but it doesn't have to be if approached with respect and curiosity. Keeping the tone light and non-judgemental can make it feel less daunting.”

2. Respect boundaries

When it comes to discussing money with friends and family, Molloy acknowledges that while it is not always necessary, it can sometimes be beneficial. "Talking about money with trusted people can give you different perspectives, advice, or even support if you are going through a tough time. Of course, it’s a personal topic, and not everyone will be comfortable with it, so it is important to respect boundaries.”

3. Start with more general topics

For those who feel uneasy initiating financial discussions, she suggests “easing into it by talking about something general, like the cost of living or saving for the future. Talk about everyday spending or your financial goals for the future. Over time, it will become easier to tackle the bigger topics like budgeting or debt.”

4. Practice makes perfect

Feeling more comfortable with financial discussions can take time and practice until it feels more natural in your everyday life.

“The key is to create a safe space for open dialogue. Over time, you will find that talking about money becomes much easier and less of a big deal. Approach the conversation with a bit of curiosity, ask questions, and listen without making assumptions. It is about building a habit of being honest and open, even about the tricky stuff."

Where to get help?

The main thing to remember if you're experiencing money worries and debt stress is that it's common and manageable.

If you're worried about money and are already an Aqua customer, you can speak to us about your concerns. We're always happy to help.

There are also plenty of helpful resources online:

If you're experiencing the symptoms of anxiety or depression due to money worries, speak to your GP or go to the NHS website to find out more about the help and support available.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Hayley Bevan

Hayley is an editor at Aqua.

Victoria Smith

Victoria is an editor at Aqua.

You might also like

Slide 1 of 3

Financial learnings and mistakes

Aqua’s latest survey explores Brits’ biggest financial learnings and mistakes.

Victoria Smith

How to budget effectively

Find out how to keep on top of your finances and become a budgeting pro.

Sharvan Selvam

Financial freedom in the UK

We’ve explored which cities in the UK are better suited for those working towards financial freedom in the UK

Sharvan Selvam

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score