In this article

What is a credit card and how do they work? - Credit cards explained

Learn what credit cards are, how they work, and how to get the most out of these great financial tools

Credit cards are often surrounded by confusing terms. But when you strip away the industry jargon, they’re more straightforward than you might think.

Provided they’re used sensibly, a credit card offers flexibility to build better credit, organise budgets, and stay on track with your finances. And depending on your credit card provider, you might be eligible for perks and rewards along the way.

To help you decide whether a credit card is right for you, we’ll explain what they are, how they work, and everything else you need to know ahead of making an application. Let’s get started

What is a credit card?

A credit card lets you borrow money up to an agreed amount, otherwise known as a credit limit. Similar to a debit or prepaid card, you can use a credit card to pay for things online, at the shops, or in restaurants almost anywhere in the world.

Every time you make a purchase, the transaction amount is added to your balance which can be paid back in full or regular instalments. If you pay back what you borrow in full each month, you usually won’t pay any interest on your purchases.

But if you carry a balance forward, your card provider will typically add interest to your balance which increases the total amount to repay. Failure to meet payments or exceeding your credit limit can lead to a negative impact on your credit score, resulting in bad credit.

As with other types of cards, a credit card has different types of payment networks such as Visa and Mastercard, both of which serve to process payments for purchases, checking with your card provider whether a transaction should be accepted or declined

How do credit cards work?

A credit card works by letting you borrow money up to an agreed credit limit set by your provider. It can be used for everyday purchases such as groceries, online purchases, paying for a meal at your favourite restaurant, or anywhere that accepts credit card payments.

By having access to credit for everyday purchases, a credit card can be a great financial tool for secure payments. It can also help you build better credit and regain control of your finances, provided you manage your account responsibly.

Every time you make a purchase using your credit card, the amount is added to your balance. If you pay back what you borrow in full each month, and you only use your account for purchases, you won’t pay any interest. But if you need financial flexibility, you have the option to carry forward your balance with added fees and interest.

You may also be charged interest on certain transactions right away, for example cash withdrawals and balance transfers. These types of transactions may also carry other credit card charges, so always check what you’re signing up to ahead of getting a credit card.

Depending on your provider, you’ll have a range of payment options to pay off your balance. With Aqua, you can choose to pay the full balance, the payment requested, a boosted payment, or the contractual minimal payment.

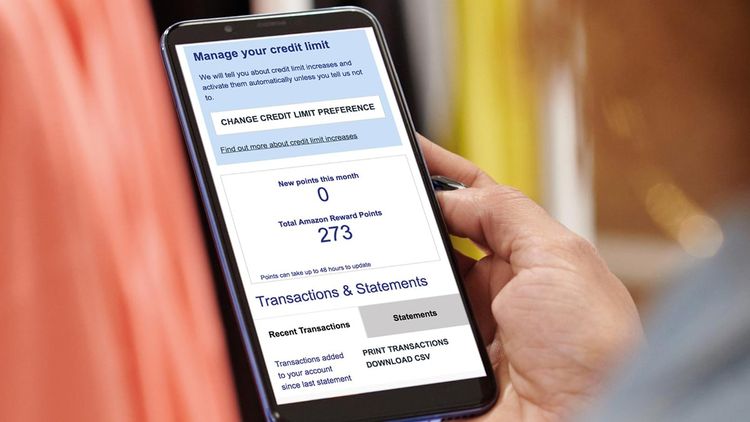

You can check your balance whenever you want by logging into your account or by calling your provider. You can also set your contact preferences to receive a digital copy of your monthly statement or have it sent by post to your registered address.

Some credit cards may offer an interest-free period, otherwise known as a grace period. During this promotional time frame, you can use your credit card to make purchases without paying interest charges, as long as you pay your balance in full by the due date.

You still need to make at least the minimum payment towards your balance every month. Standard rates will apply after the promotional period expires.

How to use a credit card

A credit card can offer financial flexibility and help you build better credit, provided it’s used sensibly. You can purchase products and services on your card either in-store using a point-of-sale terminal, or online by entering your card details. You can also set up direct debits to pay utility bills and other recurring expenses.

Other ways to use a credit card include balance transfers, which give you the option to transfer the balance from one or multiple cards to another. You might decide to transfer a balance to avoid paying higher rates of interest, or to consolidate multiple balances to a single account.

Whichever way you use a credit card, it’s best to pay off as much of your balance as you can each month. By paying at least the minimum amount by the due date, you’ll avoid paying unnecessary late fees and protect your credit score.

If you need to carry a balance forward from one month to the next, there are steps you can take to build your credit score and reduce your credit card debt. The first is to try and pay more than the minimum required every month, either with a single payment or by multiple smaller payments.

You can also set up a direct debit to make payments automatically or sign up to alerts from your credit card provider to remind you when payments are due. Whatever works for you and your financial situation.

If you do find yourself carrying a balance on your credit card, the priority is to make sure your unpaid balance doesn’t escalate into unmanageable debt. Stick to the minimum payments and make them on time every month. Over time, you’ll find your balance will shrink and you’ll be able to pay it off in full.

What is a credit card statement?

A credit card statement is issued monthly to show you where and when your credit card was used, together with the amounts you spent. The main things you’ll find on your statement include:

· Details of everything you’ve spent on your card since your last statement

· Details of interest and other charges added to the account

· The total amount due (the balance)

· The minimum amount you need to pay that month

· The date by which you need to pay the minimum amount

· How you can make payments.

You should check your statement when you get it each month to make sure all the details are accurate. If you spot something that doesn’t look right, get in touch with your card provider straightaway.

What are the main advantages of a credit card?

There are many advantages of using a credit card. As well as offering purchase protection, it can help you spread your costs, earn rewards, and transfer balances. By implementing the right strategy and paying your balance on time each month, a credit card can also help you build and maintain a healthier credit score.

Other things to bear in mind

Before applying for a credit card, it’s good to think about how you’re going to use it. There are a few key considerations that can help you decide whether a credit card is right for you, and which card to choose::

- How you use it – You need to make at least the minimum payment every month. It’s also a good idea to think about whether the credit limit suits your needs.

- Fees and charges – If you’re planning to use your card to withdraw cash, it’s worth noting almost all credit cards charge a small fee to do so. Other fees include balance transfer fees and interest.

- Charges for spending abroad – Most credit cards charge you for using your card abroad. To avoid a costly surprise on your return, it’s best to check with your provider what charges apply.

- If you already have other cards – If you’re close to your credit limit on other cards, it’s a good idea to focus on paying off the balance of your existing cards rather than taking on a new one. To help, we’ve created a guide to reducing credit card debt with helpful tips about how to take control of your balance. The exception is if you take out a balance transfer card to help consolidate your existing debt and move your balance to a lower interest rate.

- Checking you’re eligible – Before you start applying for cards, use our FREE SafeCheck Eligibility Checker to see if you’re likely to be accepted. SafeCheck is a ‘soft’ credit check, which means that you can see it in your credit history but lenders can’t, so it won’t affect your credit score or chances of being accepted for other credit.

Representative 34.9% APR (variable) for Aqua Classic.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Hayley Bevan

Hayley is an editor at Aqua.

Victoria Smith

Victoria is an editor at Aqua.

You might also like

Slide 1 of 3

Carrying a credit card balance

Learn what it means to carry a credit card balance and how this could affect your credit score.

Vanessa Stewart

Reducing credit card debt

Finding it difficult to clear your card debt? Discover some quick ways that you can start shifting your balance and...

Victoria Smith

What is a credit limit?

What is a credit card limit? Discover how credit limits are calculated, what happens if you go over, and how to man...

Hayley Bevan

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score