In this article

Financial learnings and mistakes

Aqua’s latest survey explores Brits’ biggest financial learnings and mistakes.

With almost a third of UK adults feeling negatively about their financial situation, the conversation around financial wellbeing is more relevant than ever. Our latest research revealed that nearly one-third (31%) of UK adults have a bad credit score, but more positively, 74% of those are taking active steps to improve their credit rating.

To learn more, we surveyed 5,000 people in the UK to explore the prevalence of bad credit scores and financial mistakes across the nation and reveal what people's biggest financial learnings are. We also share actionable insights on how you can start taking steps to improve your credit score and overall financial wellbeing.

How does the UK currently feel about their finances?

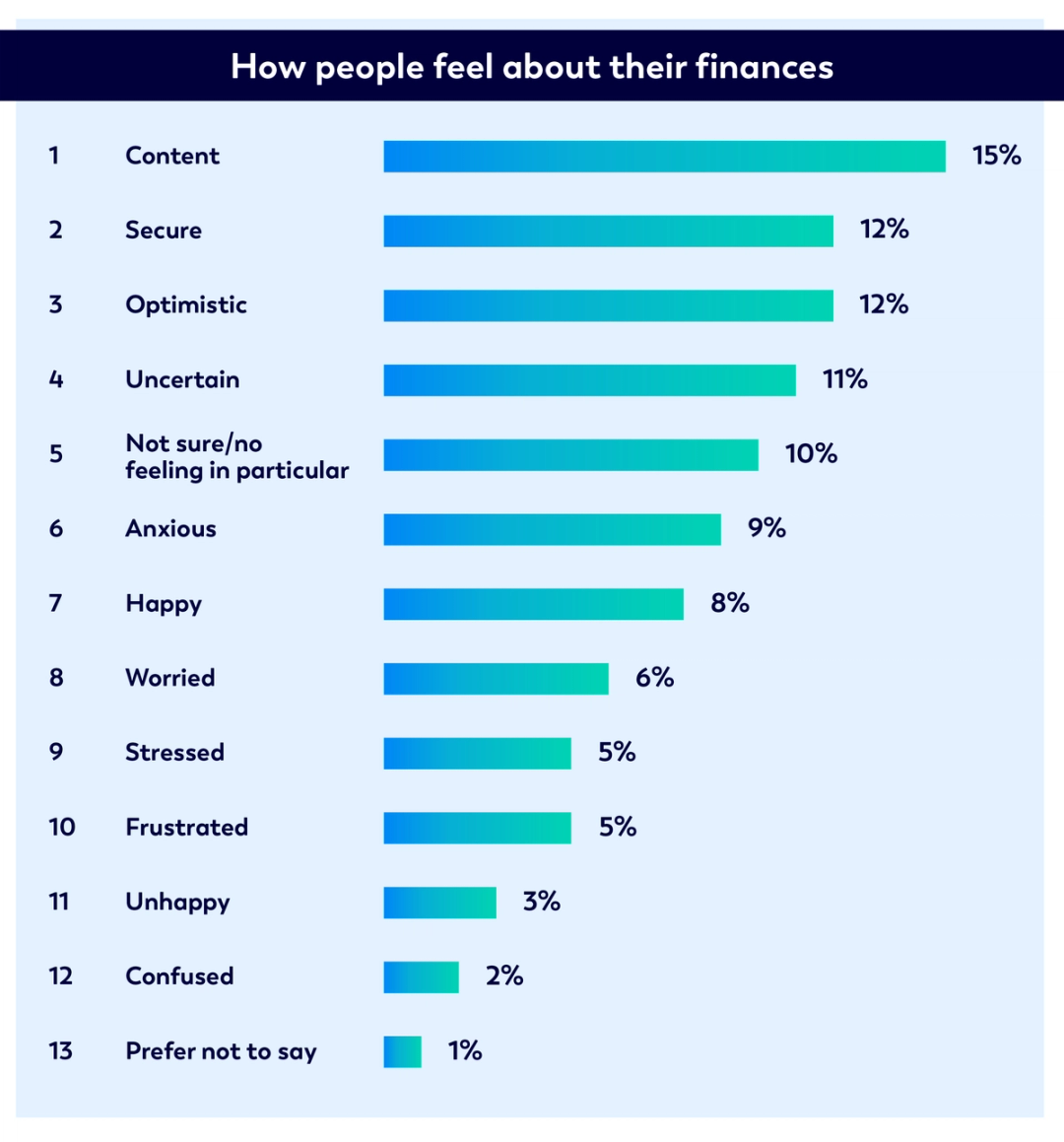

Our survey reveals that despite the tricky financial landscape the UK is currently experiencing, people still have many positive emotions towards their financial situations. The most common feeling is one of satisfaction, with 15% of respondents expressing they feel 'content,' closely followed by 12% who feel 'secure' and another 12% who are 'optimistic' about their financial future.

However, despite these positive sentiments, some of the UK population still feel unsure about their finances. Our survey revealed that just over one in 10 (11%) Brits feel ‘uncertain’ about their current financial situation, and a further 9% feel 'anxious’.

The emotional impacts of bad credit

For Brits already feeling uncertain about their finances, having a low credit score can add to the strain. Among those with a bad credit score, 26% said it causes them stress, making it the most common response. However, feelings of frustration, anxiety, and concerns about the future are shared by 21% of respondents, highlighting the challenges many face. While these emotions are common, they also reflect a desire for greater financial stability and control.

Our data also reveals age-related differences in emotional responses to a bad credit score. Stress is relatively consistent across age groups, but it peaks among those aged 35 to 44 (31%) and decreases for those 55 to 64 (21%), suggesting younger and middle-aged adults feel more pressure about their financial situation.

Unlike stress, which stays relatively consistent across age groups, anxiety over a bad credit score seems to increase with age or exposure to long-term financial commitments. With retirement concerns and fixed incomes to consider, these costly milestones appear to show emotional strain in the data. Younger adults, aged 18 to 24, experience the least frustration (16%), and anxiety peaks at 30% among those aged 55 to 64.

The financial impacts of bad credit

In addition to the emotional effects of a bad credit score, the survey revealed the most common financial impacts on Brits. The top consequence, experienced by 24%, is paying higher interest rates on loans or credit cards, underscoring the financial impact a poor credit score can impose.

Close behind, 23% report struggling to get accepted for a credit card, reflecting the difficulty in accessing new lines of credit. Being denied a personal loan (21%) and facing challenges in securing one (18%) are also significant issues, demonstrating how a bad credit score can limit borrowing options.

Interestingly, 18% report no financial impact. This may be a proportion who are not seeking loans or a credit card and therefore do not encounter the same challenges as those who do. At 11%, difficulties in obtaining a mobile phone plan and a mortgage also emerge as notable challenges, revealing how bad credit can affect both essential services as well as long-term financial goals like homeownership.

The health impacts of a poor credit score

For those with a bad credit score, the impact on health can be significant, with 31% revealing a reduced quality of life. The same is true for mental health, with 29% experiencing worsened mental health compared to just 15% of the general UK population. A bad credit score can limit access to crucial financial products, such as credit cards or loans, amplifying the stress and impact on everyday life.

Improving your credit score to reduce stress

However, a bad credit score doesn’t have to be a lasting challenge, and there are simple ways to improve it. After boosting their credit score, many Brits say they feel a lot more positive. The most common reaction is relief (35%), followed by feeling more in control (32%). About 30% feel optimistic, and 27% are confident about their finances. Plus, 23% say they feel proud of what they’ve accomplished, showing how better financial health can lift your spirits.

Sharvan Selvam, Commercial Director at Aqua, says, “Improving your credit score might not always be top of mind, but it plays an important role in helping you reduce financial stress. It’s incredibly encouraging to see so many people feeling more empowered and confident as a result of taking steps to boost their credit score, and that nearly a quarter of those we surveyed expressed a sense of pride in doing so. Building a stronger credit score is possible with small steps such as making credit repayments on time, which can be made easier by setting up a direct debit or repayment reminders, staying within your credit limit, making sure you are registered on the electoral role at your current address and correcting any errors on your credit report. Each step can have a positive impact on your path to financial wellbeing.”

What are the biggest financial mistakes made by UK adults?

To help you stay positive about your finances, it’s worth knowing the most common personal finance mistakes others have made, so you can try to avoid them. With only 21% of UK adults claiming they’ve never made a financial mistake, it is evident that most people encounter some form of challenge at some point when managing their money.

Among those who admit to making a financial error, impulse buys appear to be the most common pitfall, with one in five falling into this financial trap. This can often lead people to spend outside of their means, and with 17% admitting to this mistake, you are not alone if you do too.

It’s not just overspending that is leaving people vulnerable - under-saving is almost as common. In fact, 16% of people admit their biggest mistake is not saving regularly enough. To avoid being in a similar situation—like the 15% who found themselves without an emergency fund, or the 14% who didn’t plan for retirement—it’s important to start saving for your future as soon as possible.

Sharvan says, “With online shopping at our fingertips, it’s easy to fall into the trap of impulse buying. Before each purchase, take a step back and ask yourself if the purchase is within your budget using these two steps:

- Try waiting 48 hours before you buy. Taking the time to pause will help you see whether you really need the item. Instead of seeing the monetary value of an item, see it as how many hours you need to work to afford it. This perspective can help you decide if the purchase is truly worth it.

- Know your disposable income. To stay within your means, it’s also important to understand what money you have left over after paying for essential costs, such as rent, groceries, and after you have set aside savings. To figure this out, deduct your essential outgoings from your total take home pay or household income to see how much you have left for non-essentials, or treats.

The impacts of financial mistakes

These financial mistakes can have both short and long-term consequences, and for many, the impact is deeply personal.

Nearly one-third of UK adults (30%) say that their financial mistakes have led to increased stress - a burden felt more by women (32%) than men (28%). A reduced quality of life is the second most common consequence, with 18% reporting this as an effect of their financial errors.

Perhaps an even more concerning revelation is that one in 10 UK adults have experienced physical health issues as a result of their financial mistakes, such as headaches, high blood pressure, and difficulty sleeping.

Key financial learnings in the UK

Understanding other’s financial mistakes can help teach us some important lessons. For many people, being more clued up on finance is the key to managing it.

The biggest lesson is how to save effectively

The ability to save and budget is the biggest lesson for the population, with just under a third of UK adults (28%) finding that learning to save effectively is the biggest and most beneficial financial lesson they’ve learned. Creating and sticking to a budget follow close behind, with 17% and 26% naming these lessons the biggest they have learned, respectively.

Sharvan says, “Creating a budget can seem overwhelming at first, but having a basic budget in place is the first step to saving effectively. Start by gathering your statements and receipts to understand your current monthly outgoings. Compare that against your monthly income to see if you need to cut back on non-essential spending, such as eating out. You'll then have a better understanding of how much you can save each month. The hardest part is getting started, but once you get the basics down, you'll find that managing your money is much easier and you'll feel more confident in your finances too.”

UK adults want earlier education on retirement savings

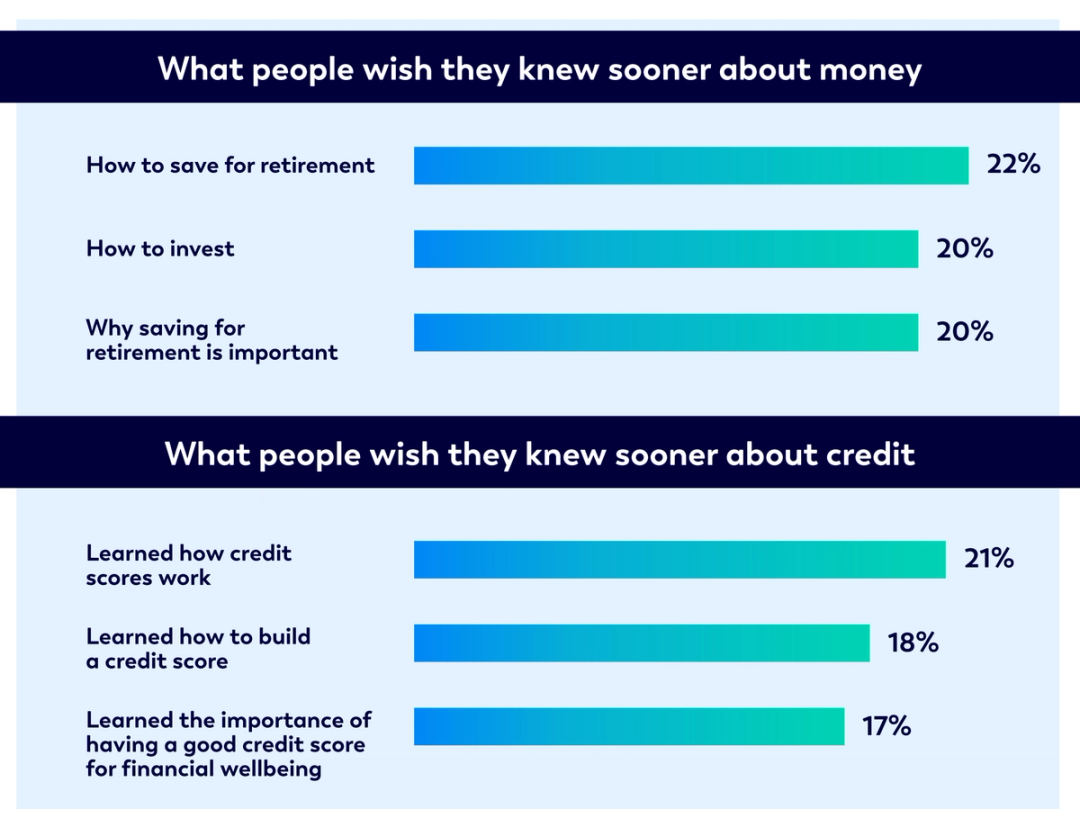

Financial literacy such as knowing how to invest is essential for making informed decisions about your money, yet 20% wish they had acquired this knowledge sooner.

Among other financial lessons, 22% of UK adults wish they had learned how to save for retirement earlier. This seems most prominent for those aged 45 to 64, with 27% saying so. However, 24% of those aged 35 to 44 agree, suggesting that adults are starting to consider their retirement saving plans around this time.

These considerations are also evident in the 20% of UK adults wishing they knew why saving for retirement is important sooner. Regarding broader saving goals, 17% of UK adults wish they had learned why having a budget is important, while 18% wish they had understood the benefits of investing sooner.

Learning how credit scores work

When it comes to credit scores, UK adults seem content with the knowledge they hold, with 44% saying there is nothing they wish they had known sooner. However, 21% of people wish they had learned about how credit scores work earlier, with 28% of those aged 25 to 34 highlighting this as one of their top lessons. Additionally, 18% of UK adults expressed a desire to have understood the process of building a credit score sooner.

Are UK adults working to build better credit?

Boosting your credit score can improve your chances of getting a mortgage or even a mobile phone contract, but most of the UK population is not actively trying to boost their credit score.

With 31% of UK adults admitting to having had bad credit scores, it’s good to see that 35% of the population are actively trying to improve theirs, although even those with a good credit score still have room for improvement.

However, Gen-Z and Millennials are working the hardest to boost their credit score, with 69% of those aged between 18 and 24 saying they are trying to improve it, and 66% of those aged 25 to 34 are also attempting to boost their score. With the average age of a first-time home buyer in the UK being 33 (excluding London), it makes sense that this age group wants to start boosting their credit to help their chances of a mortgage application.

How can I build better credit?

Our study shows that increasing your credit score can have an incredible impact on your mental and physical health and your relationship with money. In fact, 23% of people felt proud after successfully boosting their credit score. In Aqua’s latest campaign, we talked to real Aqua customers to learn more about their unique credit journeys and how, with the help of Aqua, they improved their credit scores to get ‘that better credit feeling’. With a little bit of patience and dedication, you can build your credit score too. A credit card designed for building credit, like Aqua, can be a great first step on your credit journey. By staying within your credit limit and making timely repayments, you can create a solid foundation for your financial future.

Sharvan says, “Having a bad credit score can impact your life in many ways; from being unable to take out a mortgage, to not being able to take out a mobile phone contract. However, there are a range of actions you can take to start improving your credit today.

- Check your financial history: Start getting your finances in order by reviewing your credit history. This will help you understand what factors may be holding you back so you know where to focus your efforts.

- Pay off existing debts: Lenders consider your existing debts when reviewing your application, so it can help to pay down some of your current debt before seeking more credit. Consider creating a written plan that outlines your total debt, remaining balances, and upcoming payment dates.

- Make your repayments on time: Lenders like to see that you can keep up with your financial commitments so be sure to always make your repayments on time and stay within your credit limits on any credit cards.

- Register for the electoral role: This help lenders verify your identity and can quickly add several points to your credit score.

- Keep old accounts open: By keeping open old accounts that are in good standing, you show lenders that you can successfully manage multiple credit accounts over a long period of time.

- Keep your credit utilisation low: avoid using more than 30% of your overall credit limit as this is perceived more positively by lenders.

Get more advice on fixing your credit score.

Notes to Editors:

About Aqua:

Aqua strives to help you build better credit no matter your financial situation. We aim to give people a chance by saying yes responsibly when other lenders may say no and provide the right tools and support to help you on your way towards a better credit score. Since 2002, we’ve said yes to over 2 million people so they can start their journey towards better credit. Representative 39.9% APR variable for Aqua Classic.

Methodology & Sources:

To uncover how the UK currently feels about their finances and their attitudes towards credit scores, Aqua surveyed 5,000 UK participants. Questions included how they felt about their current financial position, whether they had experienced bad credit and if they are actively trying to improve it, and how this has affected their lives financially, emotionally, and physically. They were also asked what key financial lessons they had learned and if there were any that they wished they had known sooner.

These responses were then filtered into various demographics to determine how different regions, genders, and age groups responded.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Victoria Smith

Victoria is an editor at Aqua.

Vanessa Stewart

Vanessa is an editor at Aqua.

You might also like

Slide 1 of 3

Dealing with money worries

Find out how to deal with debt stress and money worries in a practical way.

Victoria Smith

Financial freedom in the UK

We’ve explored which cities in the UK are better suited for those working towards financial freedom in the UK

Sharvan Selvam

How long does it take to improve your credit ...

Get tips and advice on how to improve your credit score.

Jide Davies

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score