Why should I use a digital wallet?

Find out how spending with digital wallets such as Apple Pay and Google Pay could be safer and easier.

More and more people are using digital wallets like Apple Pay and Google Pay to buy goods and services online or in shops, and even to board public transport. So what’s the appeal? We look at why digital wallets can be a quicker, safer and more convenient way to pay – and explain how to use them.

What is a digital wallet?

A digital wallet is a piece of software that encrypts and securely stores your payment information and passwords. The most popular and widely used digital wallets are Apple Pay and Google Pay, so we’ll focus on those here.

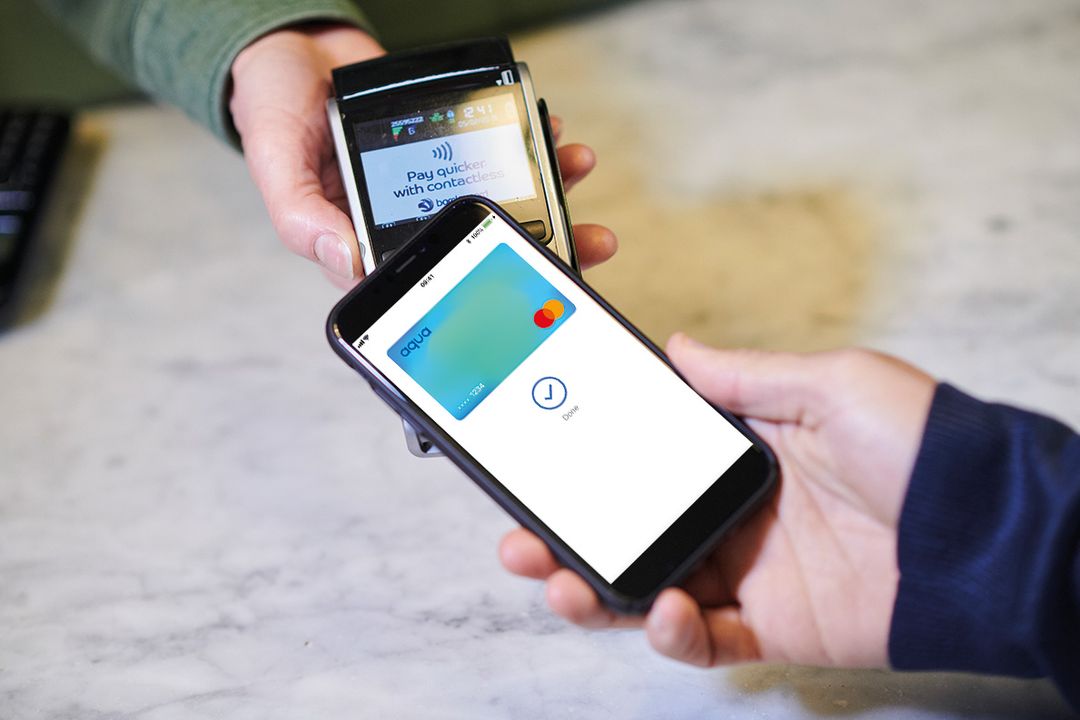

Once a digital wallet is set up on your phone, you can use that device to make payments from your credit or debit card – even if you’ve left your real wallet at home. You simply hold the phone up to any contactless card reader, authenticate with your fingerprint or face ID, and the funds should transfer to the merchant concerned.

All the contactless card readers you see in shops, restaurants and the like are set up to accept payment this way. They use something called ‘near-field communications technology’ to allow your phone and the reader to ‘speak’ to each other.

It’s not limited to phones, either. Devices like Apple watches can also be compatible. So if you’re out for a run or walking the dog without your phone or wallet, there’s nothing to stop you popping into a coffee shop – paying for your cuppa with your watch.

And if you’re travelling on the Transport for London network, you can even just tap your device on the yellow card reader to pay your fare.

Is it safe?

Concern about security is probably the biggest barrier that holds some people back from using a digital wallet. And that’s a pity, because in fact it’s an extremely safe way to spend.

When you pay with a credit or debit card through a digital wallet, you get all the same protection that you’d have if you used the card directly. For example, if you use a credit card to buy goods worth between £100 and £30,000 that turn out to be faulty, or the seller goes bust before you receive them, you can claim the cost back from the card provider

However, a digital wallet also gives you even more layers of security and peace of mind:

1. Most transactions need your authentication

You’ll usually be asked to authorise payment the same way you unlock your phone – with a PIN number, fingerprint or facial recognition. This makes transactions more secure than simple contactless card payments.

Both Apple Pay and Google Pay do allow you some transactions without this authorisation, though. For example, Apple Pay has an ‘express’ mode that you can use on public transport in London – a quick way to get through the barriers without using your fingerprint. Google Pay lets you make transactions that are below £30 without authenticating them, although you’ll need to unlock the phone after making a couple of these.

2. Your card details are never shared

When you set up Apple Pay or Google Pay, you’ll need to enter your credit or debit card details. However, that information is never stored on your phone or passed to Apple or Google. Nor does it go to the businesses you pay with your digital wallet. Instead, it’s encrypted and turned into a virtual account so secure that even you can’t view it.

Each time you spend with your digital wallet, a ‘token’ is generated – a unique, encrypted code that authorises the card reader to take a payment. With Apple Pay this happens on the phone itself, meaning you don’t have to be connected to the internet. Google Pay needs internet access, but a small number of tokens are stored on your device and can be used when you’re offline.

3. It’s easy to block your phone if you lose it

If your phone is lost or stolen, you’ll want to stop anyone using it to make payments. Thanks to online tools like ‘find my phone’ from Apple, or Google’s ‘find my device’, this is straightforward.

It’s also a good idea to cancel the card linked to your digital wallet, for extra peace of mind. However, if any fraudulent payments are made with your phone, you’ll get the same protection as you would with the card itself. The card provider will refund any money you lose through unauthorised payments.

What will I gain by using a digital wallet?

Here are just some of the advantages:

- Get all the benefits of using your credit or debit card, without the need to carry a piece of plastic

- Spend with extra security in countless places – shops, restaurants, bars, taxis and many more

- Avoid germs – no need to touch buttons or handle cash

- Pay quickly and easily – you can even speed through online checkouts and in-app payments with your digital wallet

- Make purchases above the limit of £100 that normally applies for contactless card payments

How do I start using a digital wallet?

Setting up a digital wallet takes a matter of moments. Depending on which phone you use, Apple Pay or Google Pay should already be installed. And the good news is that you can easily add your Aqua card to either of them.

How to set up Apple Pay

There are two ways to do this:

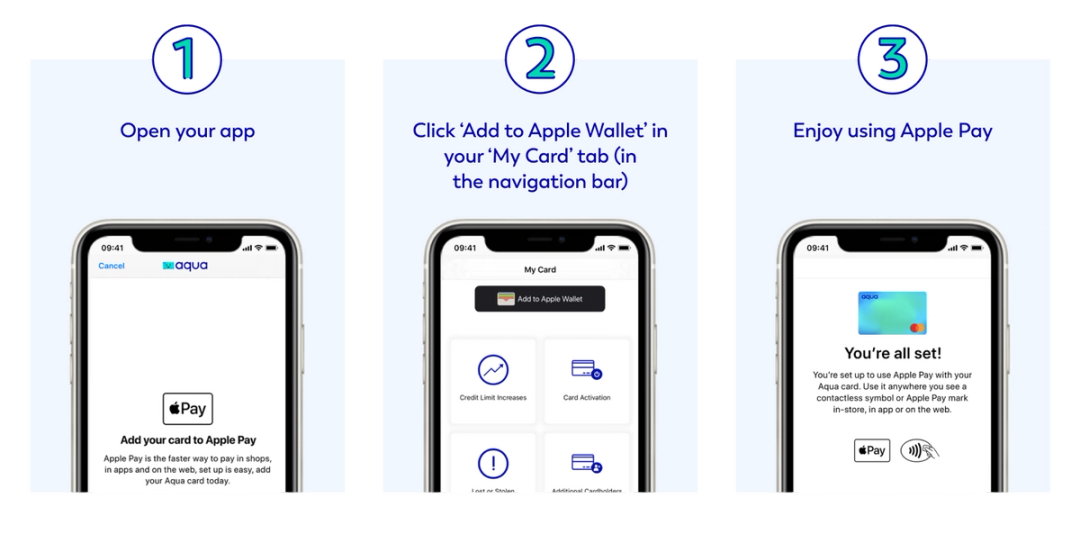

1. In the Aqua app:

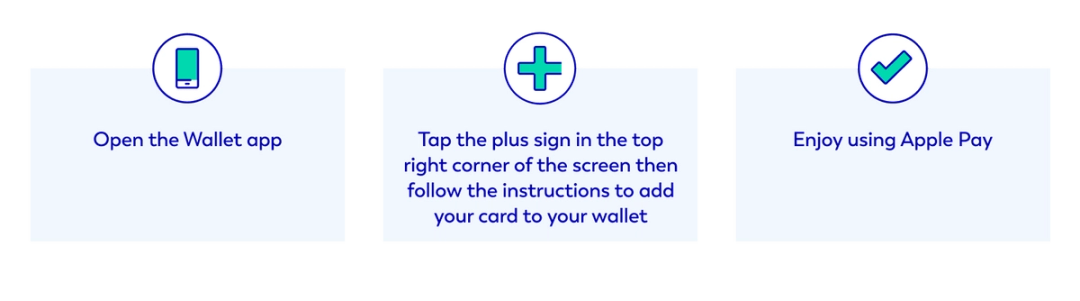

2. From the Wallet app on your Apple device

How to use Apple Pay with your iPhone

Set Aqua as your default payment card

Open the Wallet app, tap and drag your card to the front of the stack, then release. You can add up to 12 cards to Apple Pay on your iPhone.

Find out more, including how to set up your card with other devices and enable Express mode, on our special page about using Apple Pay.

How to set up Google Pay

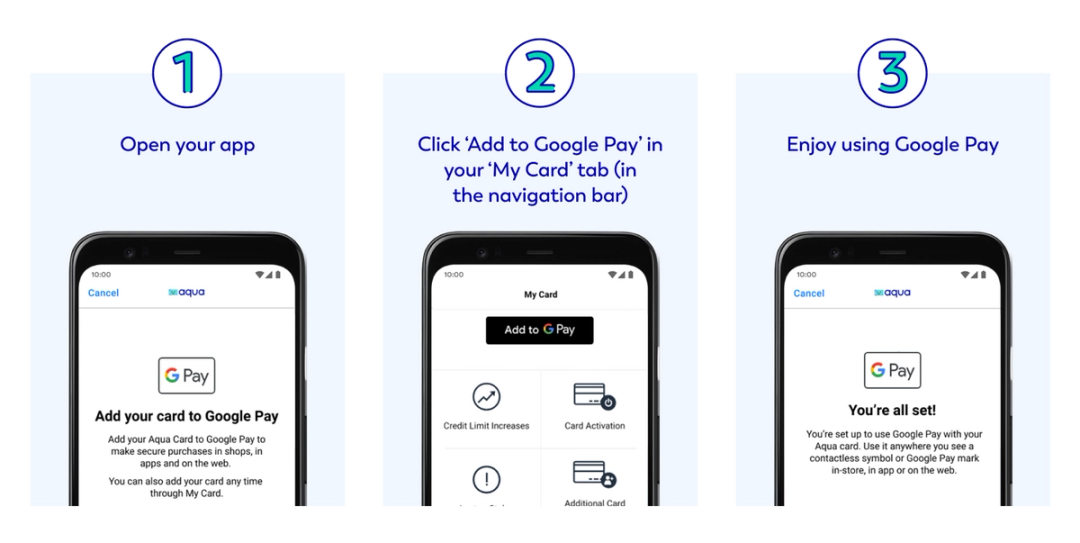

1. In the Aqua app

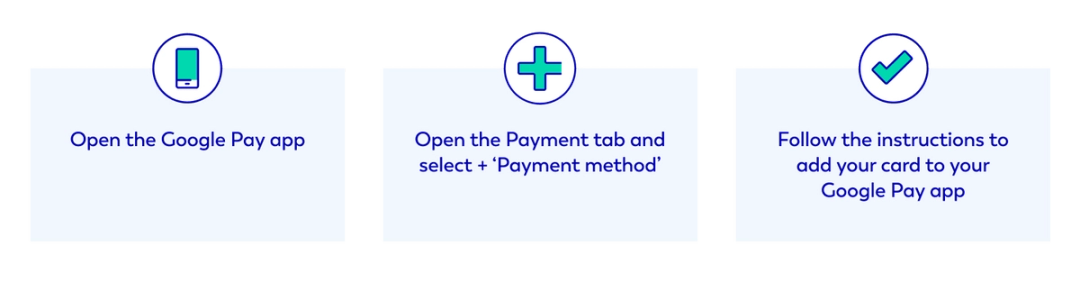

2. From the Google Pay app on your device

How to use Google Pay to make contactless payments

Find out more, including answers to FAQs, on our special page about using Google Pay.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Victoria Smith

Victoria is an editor at Aqua.

Vanessa Stewart

Vanessa is an editor at Aqua.

You might also like

Slide 1 of 3

Advantages of using a credit card

From spreading costs to building credit history, learn the benefits of credit cards when used responsibly.

Vanessa Stewart

What is a credit card and how do they work? -...

Discover the basics of credit cards, how to use them, and the benefits of using credit cards in our comprehensive g...

Hayley Bevan

Using your credit card abroad

Find out how you can use your credit card to spend abroad safely, with tips and advice to utilising your card sensi...

Victoria Smith

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score