What is a good credit score range?

Discover what the average credit score in the UK is and what this means for you.

‘What is a good credit score?’ is a question often asked by those applying for a loan, mortgage, or even a new credit card. But ultimately, there is no universal answer.

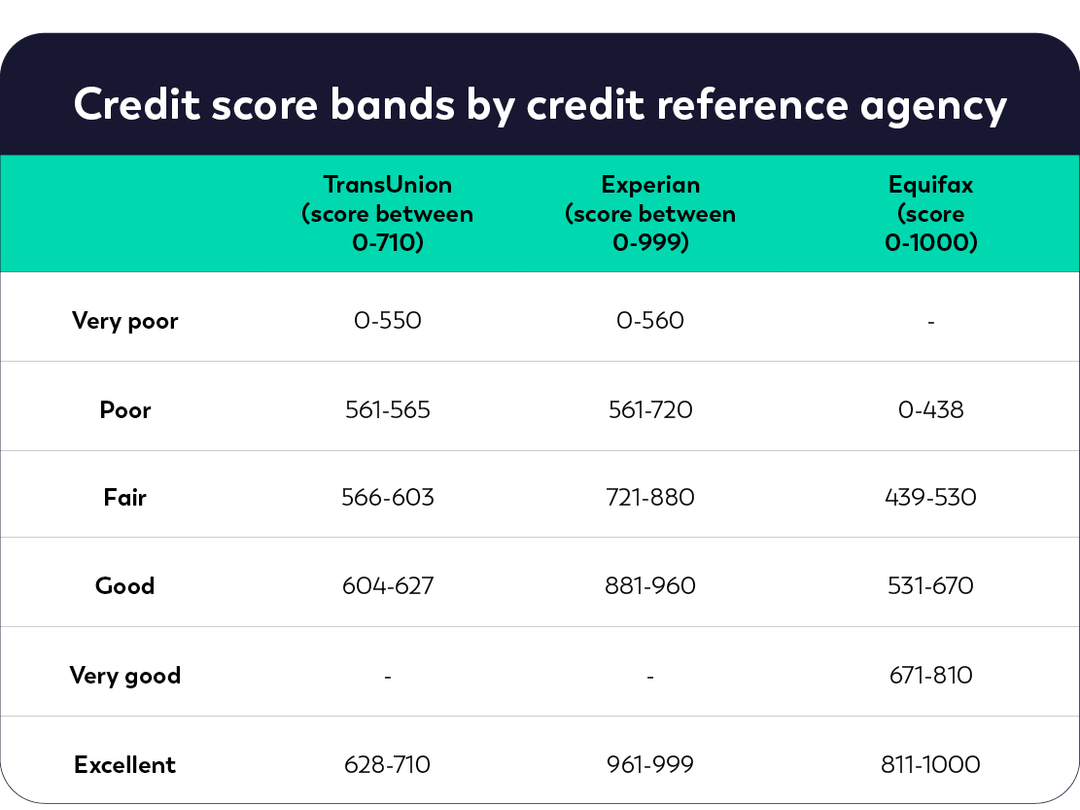

This is because the answer is different depending on the particular lender you're dealing with, who will have their own set of lending criteria. In addition, whereas a higher score will generally mean that lenders see you as lower risk, different credit reference agencies use different scoring models. For example, a score of 531 to 670 is considered ‘good’ with Equifax. But for Experian, a ‘good’ credit score is considered to be between 881 and 960. Your credit score can look different depending on which credit scoring service you are using to keep track of it.

If you’re an Aqua customer, you can check your credit score for free using Aqua Coach, available in the Aqua app (powered by TransUnion).

What does good credit mean & why is it important?

Your credit score is a number that summarises your creditworthiness, taking into account your credit history. A good credit score can demonstrate to lenders that you’ve been responsible with your finances in the past, which can help to secure a loan, mortgage, or even a new credit card.

What a good credit score looks like varies between credit reference agencies and the scoring models they use to arrive at your score. What this means is there’s no universal number that determines a ‘good’ credit score.

Here is what’s considered a ‘good’ credit score at each credit reference agency:

- Transunion: 604-627

- Equifax: 531-670

- Experian: 881-960

Once a score has been calculated, lenders will combine this information with other financial factors, such as checks on your outgoings, existing debt, credit history and various other factors to determine how likely you are to pay back what you borrow.

It is possible to secure credit with a low credit score. However, if your score is higher, you’re more likely to be seen as a lower-risk borrower by lenders and may benefit from higher credit limits, lower interest rates and faster loan approval. With a fair or poor credit score, however, you may have more difficulty getting credit or qualifying for better loan terms.

Does checking your credit score lower it?

Checking your credit score on your credit report is considered a ‘soft check’ or ‘soft inquiry’ and does not negatively impact your credit score. When you perform a 'soft check', a record of it will be left on your credit report for 12 to 24 months, which remains visible to you but not to lenders.

To help you improve your credit score and (if applicable) reduce your credit card debt, plan your spending carefully, set a monthly budget, and always make your payments on time.

What is the average credit score in the UK?

According to Experian, the average credit score in the UK under Experian's scoring model is 797 out of 999, however average scores vary depending on age, the area the individual lives in and the credit reference agency used. Here are some of the highest average credit scores in the UK based on location under Experian's scoring model:

- City of London 883 (good)

- Isles of Scilly 849 (fair)

- Wokingham 882 (good)

Here are some locations with the lowest average credit score:

- Blackpool 707 (poor)

- Blaenau Gwent 693 (poor)

- Kingston-upon-Hull 716 (poor)

People with higher credit scores have a better chance of securing credit and are more likely to have access to higher credit limits and lower interest rates, while those with lower scores tend not to get the best offers.

However, you can increase your chances of securing credit by applying for a credit card for building credit which are cards that typically come with lower credit limits and are more likely to accept those with lower credit scores. Always check your eligibility for a card before applying to see if you have a good chance of acceptance. When managed responsibly, a credit builder card could help you build your credit score.

What is a good credit score for my age?

When you combine age groups with location, the average credit scores start to differ. Here’s what the data looks like in several locations for varied age groups using Experian's scoring model:

Average credit score for the City of London by age group

- 890 (age group 18-20)

- 871 (age group 21-25)

- 893 (age group 26-30)

- 913 (age group 31-35)

- 846 (age group 36-40)

- 881 (age group 41-45)

- 884 (age group 46-50)

- 857 (age group 51-55)

- 908 (age group 55+)

Average credit score for the Isles of Scilly by age group

- 906 (age group 21-25)

- 888 (age group 26-30)

- 886 (age group 31-35)

- 889 (age group 36-40)

- 841 (age group 41-45)

- 934 (age group 46-50)

- 924 (age group 51-55)

- 927 (age group 55+)

Average credit score for Wokingham by age group

- 883 (age group 18-20)

- 882 (age group 21-25)

- 871 (age group 26-30)

- 861 (age group 31-35)

- 861 (age group 36-40)

- 883 (age group 41-45)

- 888 (age group 46-50)

- 890 (age group 51-55)

- 922 (age group 55+)

If you’re an Aqua customer, you can check your credit score for free using Aqua Coach, available in the Aqua app.

Credit score ranges - an easy breakdown

As we mentioned, credit score ranges will vary depending on the credit reference agency. So to help you understand where your score sits within each band, here’s a breakdown of the credit score bands for TransUnion, Experian and Equifax.

Credit score ranges by credit reference agency

Note: where a number is missing for a band, the credit reference agency does not use this banding name.

Sources: TransUnion, Experian, Equifax

Improve your credit score with Aqua

Stay on track with your credit building journey with text reminders, award-winning customer support and our free credit-building tool, Aqua Coach, available in the Aqua app.

Powered by TransUnion, Aqua Coach is an in-app tool that helps our customers better understand their credit scores, the behaviours that affect it, and what they can do to improve it.

We help over 4,000 people start their credit building journey each week and you can check if you’re eligible too in less than 60 seconds, without impacting your credit score.

Representative 34.9% APR Variable with Aqua Classic.

If you’d like to learn more about credit and the best ways to manage it, our Credit Smarts hub is full of advice and guidance to help with learning how to budget, understanding the cost of bad credit, how credit cards work, what the different types of credit cards are for, and so much more.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Jide Davies

Olajide is Head of Customer Underwriting at Aqua.

Vanessa Stewart

Vanessa is an editor at Aqua.

You might also like

Slide 1 of 3

Advantages of using a credit card

From spreading costs to building credit history, learn the benefits of credit cards when used responsibly.

Vanessa Stewart

Carrying a credit card balance

Learn what it means to carry a credit card balance and how this could affect your credit score.

Vanessa Stewart

Credit cards for low income & self-employed

Credit cards for low income, unemployed and self-employed people.

Vanessa Stewart

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score