In this article

The cost of a first date in 2024

Aqua’s latest survey looks at how Brits' dating attitudes have changed due to the cost of living crisis.

From heating bills to Netflix subscriptions, costs are going up everywhere – and our dating lives are no exception. In a survey we conducted in 2023, we found that nearly a quarter of single Brits (23%) were planning to stop going on dates to save money. So, has the dating landscape changed over the last year?

Well, the short answer to that is yes. This latest research has delved deeper into Brits’ dating habits to understand how often Brits are dating, how much they believe should be spent on a first date (and how much they are actually able to spend), and how dating attitudes have changed amidst rising costs. We’ve also provided some top tips for budgeting for the dating life you want.

How often are people dating?

With the price of meals out, drinks, and cinema tickets having significantly increased over the last couple of years, many Brits have had to rethink their dating habits. In fact, according to our research, more than half (54%) of singles say they aren’t dating in the current financial climate.

Back in 2023, 29% of women told us they were planning to stop dating altogether in response to rising costs. Perhaps this explains why our latest research has revealed that only 36% of women are currently dating. Rising costs seem to have impacted men a little less though, with nearly two-thirds (58%) saying they are still dating in 2024 (although this is down from 84% in 2023).

Looking at how dating habits compare across the UK, Newcastle has seen the biggest dip in the number of people dating since the cost of living crisis. Before the financial crisis, 45% of Geordies weren’t dating, compared to 51% now.

On the other end of the scale, Norwich has actually seen the highest number of people start dating again since costs started to rise. One in two (51%) residents said they weren’t dating prior to the financial crisis, compared to 44% in 2024.

How much should a first date cost?

Everyone’s financial situation is different, so naturally, the amount of money you spend on your dating life will vary from person to person. But, for those who are dating, how much is being spent on a first date?

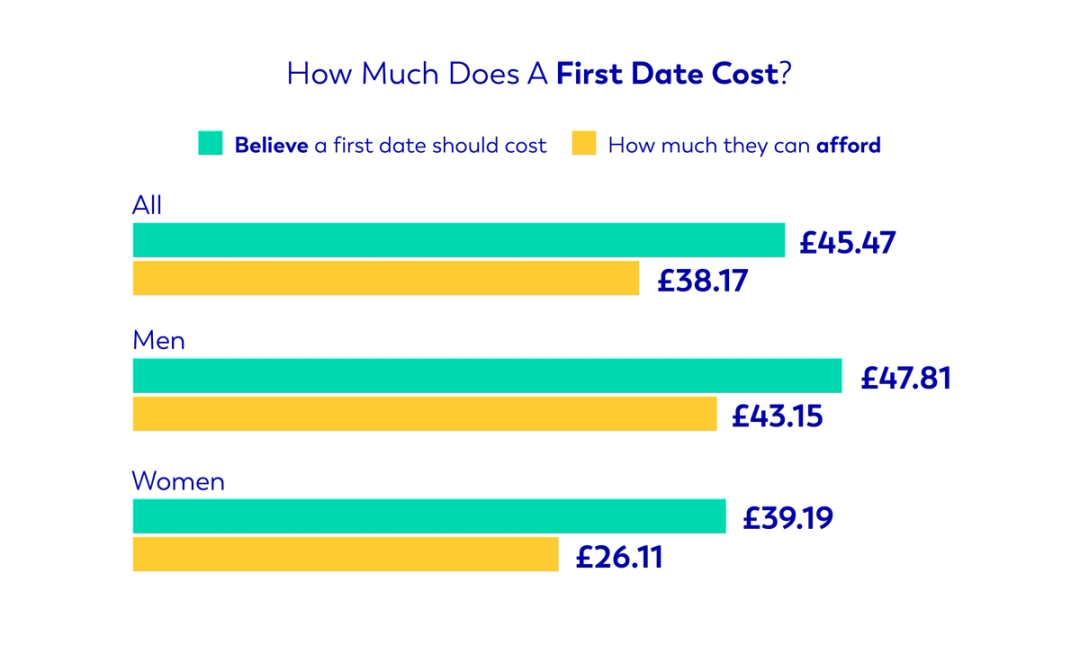

As many of us can imagine, what people would like to spend on a first date doesn’t necessarily match the amount they are able to spend. On average, Brits believe a first date should cost around £45, yet they’re only spending £38 in 2024. However, our 2023 report revealed that Brits were spending £31 on average, so it’s good to see that Brits are seemingly able to allocate around 23% more money to their dating lives this year. It’s important to note, though, that since a significant number of people have stopped dating altogether, perhaps it’s this rising cost of dating that is pricing people out.

Opinions on how much you should put toward a first date do seem to differ between men and women. Men would typically like to spend an average of £48 — though in reality, they are only able to spend £43. In comparison, we found that women would like to spend an average of £39, but they are only able to spend about two-thirds of this (£26).

The cost of a first date also seems to vary slightly by generation. We found that Gen-Z are spending the most, averaging £56 per date, despite believing you should spend around 16% less than this (£48). Baby Boomers are paying the least (£30), which is three-quarters of what they feel they should be spending (£41).

Sharvan Selvam, Commercial Director at Aqua says, “It can be tempting to overspend on a first date, especially if you want to impress. But, it’s important to remember that you don’t always have to spend a lot to have a great time.

“Putting a solid financial plan in place can help you understand how much you have available to spend on your dating life, and you can then plan accordingly to find fun activities that are within your budget.

“Remember to stick within your means and don’t feel pressured to overspend. Suggesting cheaper alternatives, such as a coffee shop date or a picnic in the park, is a great way to enjoy dating on a budget.”

Which cities are spending the most on first dates?

Dating costs might differ across genders and ages, but do certain cities across the UK have more expensive dating lives than others?

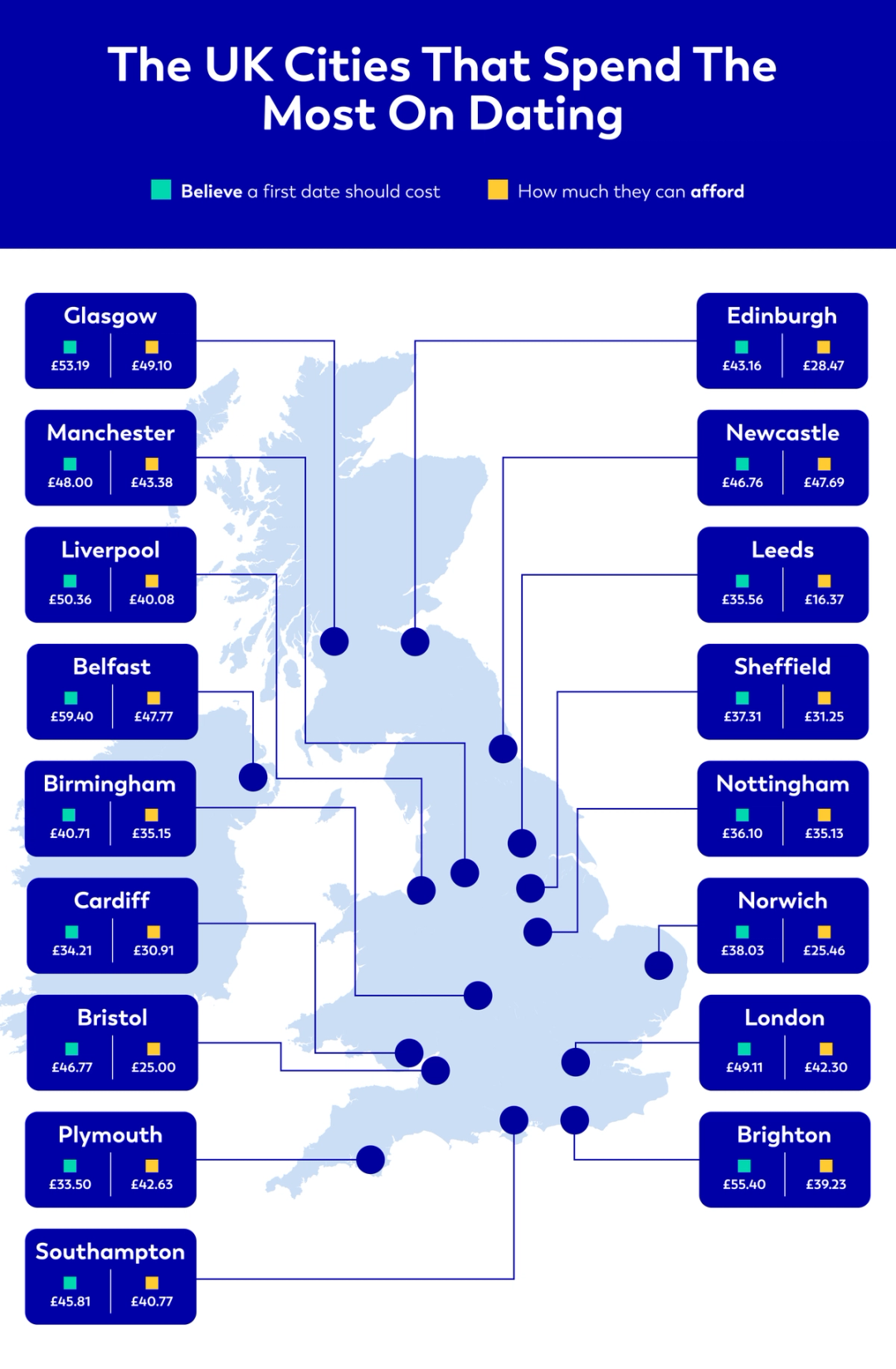

Our research found that Glaswegians are spending the most, with residents saying they usually spend £49 on a first date. This is up from an average of £33 in 2023. Belfast and Newcastle residents aren’t far behind, spending £48. Meanwhile, Leeds residents are spending the least, averaging £16 for a first date, despite suggesting they’d like to spend around £36.

When analysing which cities are overspending the most, Plymouth residents are spending £43 on a first date, 26% more than what they believe should be spent (£34). Meanwhile, Bristol locals are most likely to underspend, suggesting they’d be willing to pay £47, but finding themselves only spending around half of that (£25).

No matter your financial situation, it’s important not to feel the pressure to exceed your dating budget. Be honest with yourself about what you can afford, so you aren’t continuously overspending in your dating life.

Dating attitudes amid rising costs

Our latest survey has also taken a closer look at how dating attitudes have changed amid continued rising costs.

In our 2023 survey, 27% of Brits believed that the cost of a first date should be split evenly - and that percentage has remained the same in 2024. This is the most common opinion for women, with 37% suggesting this is how they approach dating, compared with 23% of men. Men are most likely to believe that they should cover the bill themselves (33%), though the majority of women believe in a different approach, with just 19% saying the man should pay on the first date.

Brits aged between 16 and 24 are most likely to believe that whoever asked for the date should pay, with a quarter (24%) suggesting this to be the case. In comparison, just 9% of those over 45 think it’s the ‘asker’s’ responsibility.

Meanwhile, the over 55s are divided on how they are most likely to approach paying on a first date, with 29% thinking the man should pay and the same number believing the bill should be split evenly. On the other end of the scale, just 7% of Gen-Z believe the bill should be halved, though a few more (18%) think the man should pay.

Top tips for dating on a budget

Dating might have become more expensive for many of us, but that doesn’t mean people need to stop dating altogether. Sharvan Selvam, Commercial Director at Aqua, has shared top tips for budgeting to help those who are currently dating.

1. Create a dating budget

“First things first, look at incorporating your dating life into your monthly budget. If you already have a financial plan in place, take a look at how much money you can allocate to dating and then plan your dates from there.

“If you don’t already have a budget in place, this is one of the best ways to get a clear view of your finances and will help to ensure you aren’t overspending each month.

“To create a budget, take a look over all of your essential outgoings, such as rent and groceries, and compare this to your income, which will then give you an idea of how much money you have left over for the more flexible expenses, such as dating.”

2. Look for cheaper alternatives

“First dates don’t need to be expensive, and there are plenty of low-cost or free date-night options that are still just as romantic as an expensive dinner or fancy cocktails. Try finding free local events to attend, or head outside for a picnic in the park.”

3. Be honest

“There can be pressure to impress on first dates, but the most important thing is usually spending time together to get to know one another, rather than the activity itself. If you’re feeling worried about the cost, and feel comfortable enough to do so, mention that you’d like to keep the cost down, and maybe suggest some more affordable options, such as a walk or a coffee.”

Methodology & Sources

A survey was conducted on 1,000 UK consumers. Participants spanned a variety of relationship statuses, including single, single and dating, in a relationship, married, divorced, or widowed. The survey was conducted in January 2024.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Sharvan Selvam

Sharvan is Commercial Director at Aqua.

Vanessa Stewart

Vanessa is an editor at Aqua.

You might also like

Slide 1 of 3

Self care nation

Aqua reveals the self-care priorities of people in the UK.

Sharvan Selvam

Couple's spending habits in the UK

Aqua’s new research uncovers what the biggest money challenges are for couples in the UK, and experts share tips on...

Vanessa Stewart

Everyday budgeting

Budgeting bills and everyday budgeting tips.

Sharvan Selvam

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score