In this article

What is a balance transfer?

A credit card balance transfer is when you transfer the balance from one card, where you might be paying a higher amount of interest, to another card. Read on to learn when a balance transfer could be a good option for you.

A credit card balance transfer involves transferring the balance of one card to another card. You can also use balance transfers to move balances from multiple cards onto a single card.

Many people choose to make a balance transfer in order to save money on interest repayments or consolidate their balances in one place, which can make it easier to stay up to date with their monthly payments.

What are the benefits of a balance transfer?

There are several benefits to making a credit card balance transfer, including:

- Getting a lower interest rate so you can pay less interest on your existing debt

- Making it easier to manage debt by keeping everything in one place

- Giving you the opportunity to take stock and work out all your finances

It’s a good idea to check how much the balance transfer fee is first, as the amount will vary between lenders. If you’re looking for a lower rate, you should also check how your existing rate compares with the card you are transferring to.

What is a balance transfer fee?

A balance transfer fee is charged by the lender as a fixed fee or percentage of the amount you transfer. This is usually between 2% and 5%. You would then pay interest on the amount you have transferred at the applicable interest rate for balance transfers.

You should factor in the balance transfer fee when you’re choosing a card to transfer a balance to, as it will be added to the balance of the card to which you are transferring.

For example, if you were to transfer £891 from a card with a balance transfer fee of 1% to a new card with a zero balance, the balance transfer fee would be £8.91, giving you a total balance on the new card of £899.91.

How to make a balance transfer to my credit card?

The process of making a balance transfer varies from lender to lender, but there are some simple steps you’ll need to go through:

1. Check your current balance and interest rate

Check how much you want to transfer and compare the interest rate for balance transfers and the balance transfer fee on your current card and on the card you are considering making a transfer to. This can seem daunting, but it’s worth it to work out whether how much transferring a balance to another card will save you.

In the end, you will want to pick a new card that will take the full amount you want to transfer with a lower rate of interest for balance transfers and as low a balance transfer fee as possible.

2. Choose the card to transfer the balance to

When you pick a card to transfer your balance to, you want to make sure of a few things:

- That the interest rate for balance transfers is lower than your current card – and will stay lower the whole time your balance will be on it. Many cards offer an introductory interest rate – such as a tempting 0% rate – that goes up after a few months.

- What the balance transfer fee is – even if the interest rate is 0%, most lenders charge a balance transfer fee of 2-5% of the balance.

- How much you’re allowed to transfer – check the minimum and maximum amount you can transfer and whether it meets your needs. With an Aqua card, you can transfer up to 90% of your available credit card limit (including the balance transfer fee).

- Check who the lender is – you probably won’t be able to transfer between two cards issued by the same lender, even, if the cards have different branding. For example, you cannot make a balance transfer from an Aqua card to any other card provided by NewDay and store cards.

3. Read the fine print and apply for the card

It’s a good idea to read all the details of any credit card you wish to apply for, to make sure it meets your needs and that there are no surprise fees. If you can, it’s a good idea to use an eligibility checker before you apply for a credit card.

4. Make the balance transfer

Once you’ve been accepted for your new card, you can contact your card provider to arrange a balance transfer.

5. Start paying off your balance

Once the balance has been transferred, you can focus on paying it off at a faster rate and without all that extra interest!

How long does a balance transfer take?

Balance transfers can take either a few days or a few weeks, depending on the lender and the time of year you make the transfer. Generally speaking, most balance transfers should be complete within 14 days.

How to do a balance transfer on an Aqua card

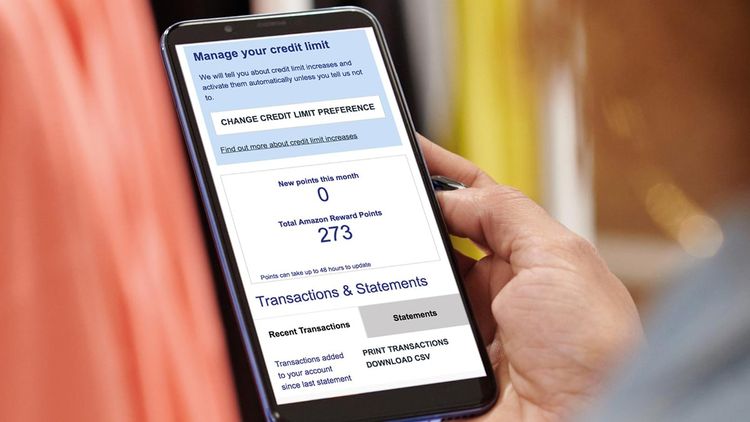

Once you’ve activated your card, you can use Online Account Manager or the Aqua App to request a balance transfer.

Once logged in, select the Balance Transfer option and tell us how much you want to transfer, providing the details of the card you wish to transfer the balance from and we will do the rest.

It’s worth checking the terms of your Aqua card to make sure you’re definitely eligible to make a balance transfer.

How much can I transfer?

The minimum you can transfer is £100, and you can transfer up to 90% of your available credit limit (including the balance transfer fee).

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Victoria Smith

Victoria is an editor at Aqua.

Vanessa Stewart

Vanessa is an editor at Aqua.

You might also like

Slide 1 of 3

What is a credit card and how do they work? -...

Discover the basics of credit cards, how to use them, and the benefits of using credit cards in our comprehensive g...

Hayley Bevan

Reducing credit card debt

Finding it difficult to clear your card debt? Discover some quick ways that you can start shifting your balance and...

Victoria Smith

Carrying a credit card balance

Learn what it means to carry a credit card balance and how this could affect your credit score.

Vanessa Stewart

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score