In this article

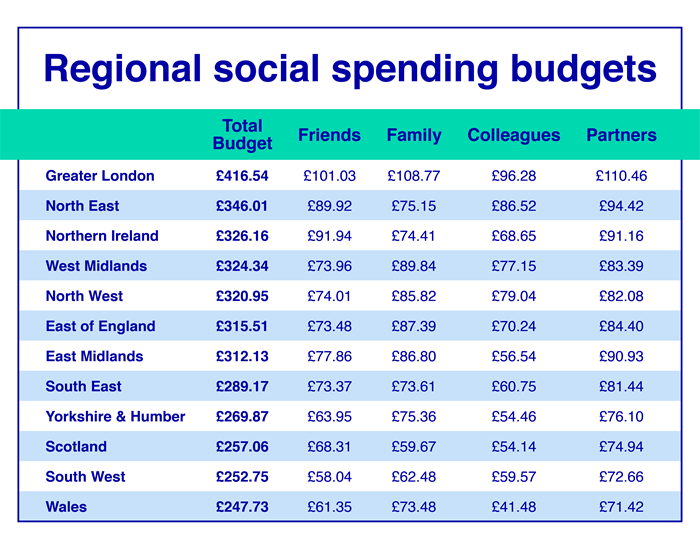

- Greater London residents are the biggest social spenders

- People from Wales are the most frugal with their social spending

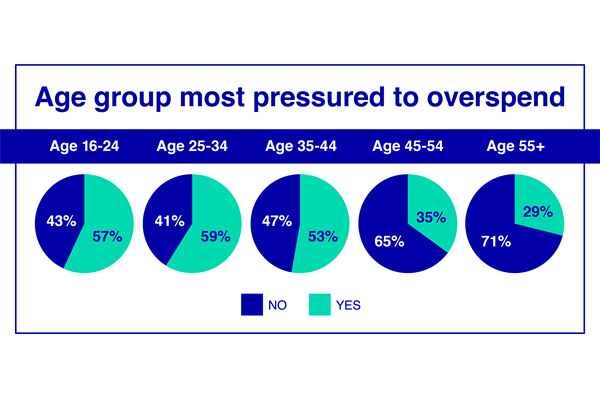

- Baby boomers are the least likely to overspend

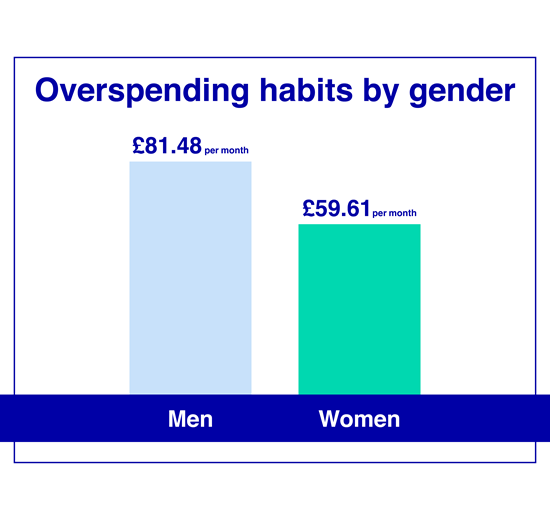

- Men spend significantly more each month due to peer pressure

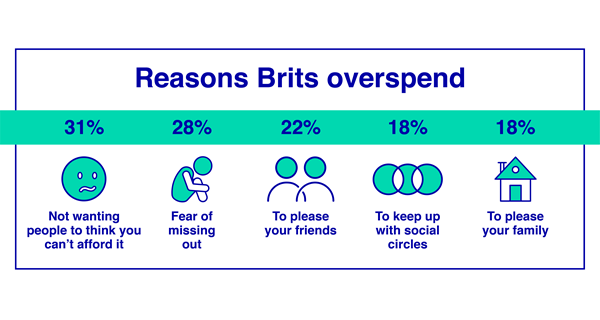

- Financial status motivates people to overspend

- Hospitality is what people overspend the most on

- Aqua’s advice for sticking to your budget

The Social Tax: UK adults overspend by £800 due to social pressures

Over a quarter of those surveyed said they overspend due to the fear of missing out.

Many of us have been guilty of overspending, but with the excitement of Covid-19 regulations lifting, our willingness to spend seems to have increased quite a lot.

We’ve surveyed 2,006 UK adults over the age of 16, to get to the bottom of which of us are overspending, why and the impact it has on our financial health. Based on this we’ve also put together some handy tips to help put our cards away and avoid overspending.

Greater London residents are the biggest social spenders

It comes as no surprise that those living in Greater London tend to spend more money on their social lives than the rest of the country. When you compare the basics of a night out like the average cost of a pint in London (£5.50) vs. other areas of the UK such as Leeds (£3.54) it’s easy to understand why Londoners have a more expensive social life.

On average, Greater London residents put aside £101.03 per month for socialising with friends, £108.77 for spending time with family, £96.28 for going out with colleagues, and £110.46 for spending time with and going out with their partner.

People from Wales are the most frugal with their social spending

In contrast to Greater London and the North East, who are big social spenders, our research showed that people who live in Wales were the most frugal when it comes to putting aside money for socialising.

On average, each month people in Wales set aside £61.35 for socialising with friends, £73.48 for spending time with family, £41.48 for going out with colleagues and £71.42 for spending time and going out with their partner.

Baby boomers are the least likely to overspend

While overspending can, and does, happen at any age, we found that those over the age of 55 were the group less likely to overspend due to social pressures. Almost three quarters (72%) of respondents over 55 said that they don’t feel pressured to spend more money than they want to.

Men spend significantly more each month due to peer pressure

Our research found that men are more likely to fall for peer pressure and overspend each month when socialising, compared to women. Men on average overspend £21.87 more each month than women. While that doesn’t seem like much of a difference, over the course of the year it adds up, so that men are overspending by £977.76, that’s £262.44 more than women who, on average, overspend by £715.32 a year.

Men’s susceptibility to overspending in social situations means that they may be more likely to end up having to use more of the funds available on their credit cards, or overdrafts, to cover their overspending.

Financial status motivates people to overspend

Social status is an influential force in society, so it comes as no surprise that one of the main reasons Brits feel pressure to overspend is that they don’t want their friends and family to think that they can’t afford the same things.

31% of those we surveyed said this was the main factor behind them feeling like they needed to spend more than they could afford. Additionally, 28% of the participants said that the fear of missing out played a big role in their overspending habits.

The survey also found that overspending to ‘maintain appearances’ impacts our mental health: 24% of those surveyed said that they felt anxious, 16% said they felt regret, and 12% felt guilty when they overspent. Only 5% of all respondents said that they felt happiness after overspending.

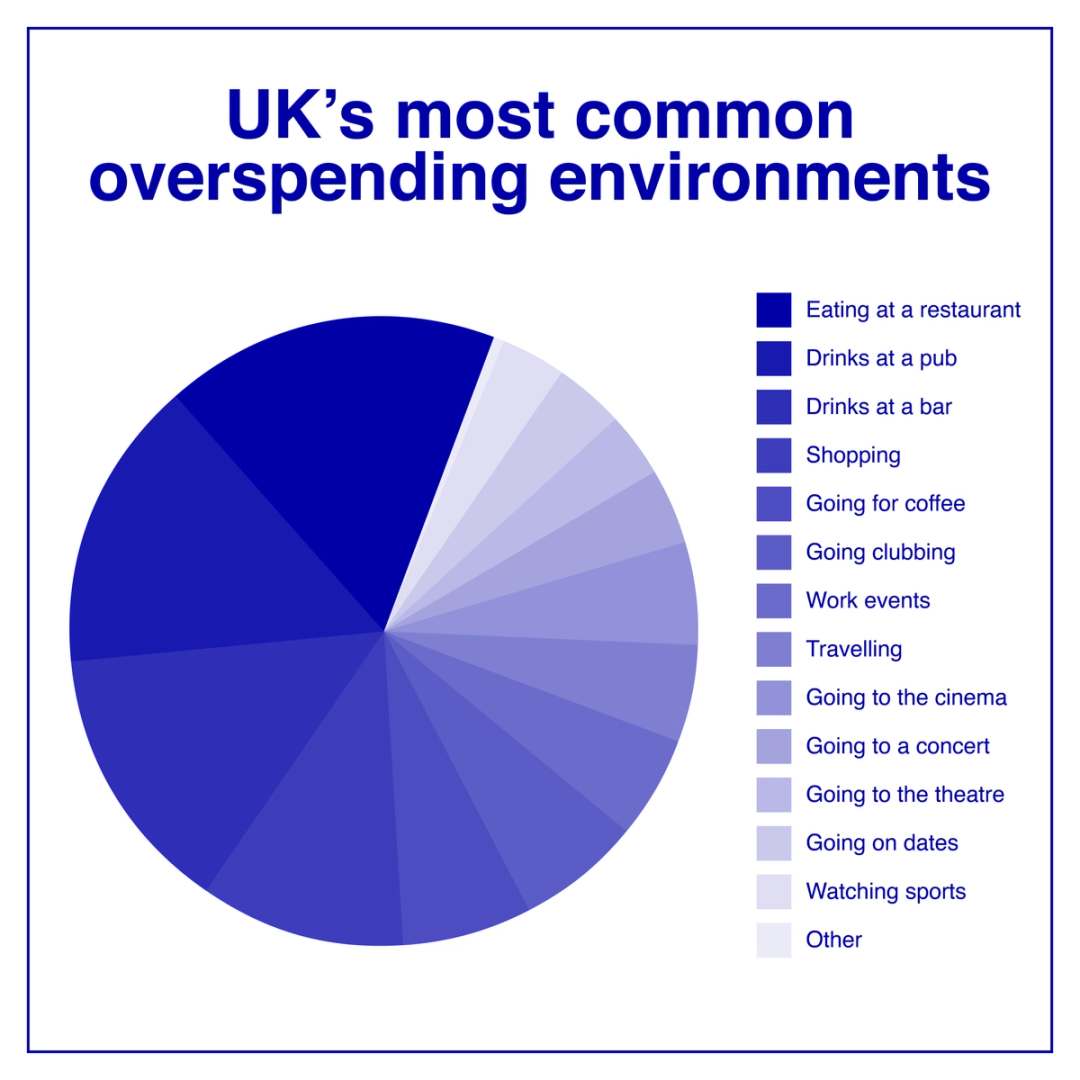

Hospitality is what people overspend the most on

The hospitality industry comes out on top in terms of where people overspend. Over a third of respondents admitted to a lot of overspending when they go to the pub.

Aqua’s advice for sticking to your budget

With more of us going out now that restrictions have eased, it’s more important than ever for Brits to have a good understanding of how to manage their finances and use credit responsibly.

Sharvan Selvam, Commercial Director from Aqua says: “Nobody should feel that they have to avoid socialising due to financial stress. Creating a budget allows you to understand what you can afford each month and reduces the risk of going over credit limits or into overdrafts. Additionally, learning to talk about finances with loved ones will help alleviate some of the pressure that you may feel to overspend.”

Here are Aqua’s tips to ensure that you don’t end up overspending:

- Know your budget: Setting a budget can help keep your spending in check. Make note of what you have to pay for and when. With the remaining money, set an allowance for things like socialising, events, and travel. This way, you’ll be less likely to go deeper into your credit card or overdraft limits.

- Communicate: When it comes to spending time with friends, family and partners it can be easy to be swayed into spending more money than you should. By learning to talk more openly about your budget, they’ll better understand your situation and will be less likely to pressure you into overspending for the sake of socialising.

- Research things to do: Planning your days out will help you know how much you’re likely to spend. You won’t have to worry as much about checking your accounts to make sure you have enough money and can instead focus on enjoying the day. Researching ahead of time is also another great way to find cheaper or free things you can do, which will be a relief to your bank accounts or credit cards.

No matter your situation, these small tips will help ensure you don’t overspend and stick to your budget.

Aqua strives to help you build better credit no matter your financial situation. We aim to give people a chance by saying yes when other lenders would say no, and provide the right tools and support to help them on their way towards a better credit score. Since 2002, we’ve said yes to over 2 million people so they can start their journey towards better credit.

Representative 34.9% APR variable for Aqua Classic.

Footnotes and sources: This survey was conducted across 2,006 UK residents over the age of 16 during Q1 2022.

Index methodology: Aqua surveyed 2,006 people in February 2022.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Sharvan Selvam

Sharvan is Commercial Director at Aqua.

Victoria Smith

Victoria is an editor at Aqua.

You might also like

Slide 1 of 3

The effect of inflation on the UK’s favourite...

With the UK’s inflation rising at the highest rate for 40 years, what can we expect our favourite items to cost in ...

Sharvan Selvam

The Great British Beer Garden

With summer around the corner, Aqua reveals which UK cities are best for beer gardens.

Sharvan Selvam

The cost of a first date

Survey finds almost a quarter of single Brits are planning to stop dating due to the cost of living crisis.

Vanessa Stewart

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score