In this article

What are the couple's spending habits in the UK?

Aqua’s new research uncovers what the biggest money challenges are for couples in the UK, and experts share tips on how to overcome these

Money can be a tricky subject to broach with your partner — especially during an uncertain financial climate. In fact, our 2023 study into couples’ spending habits found that 35% of people felt that rising costs were putting a strain on their relationship.

We’ve conducted another survey to determine whether things have improved since then, now that inflation rates have somewhat settled in 2024. We’ve also looked at how often couples talk about money, what the most sensitive financial topics are for couples and the spending habits people are most likely to hide from their partners.

To help Brits overcome some of these challenges, we’ve also partnered with Relationship Consultant and Strategist Mairead Molloy, who has advised on how couples can best navigate their finances together. Aqua’s Commercial Director, Sharvan Selvam, also provides tips for tackling some of the biggest money challenges couples face.

How often are UK couples talking about money?

Every couple’s financial situation will be different; some might be combining their money, while others will want to keep things separate. No matter your situation, it’s important to be honest and open with a partner about money. So, just how often are couples talking about it?

Our research found that only a quarter (24%) of Brits discuss finances with their partner frequently, while as many as 39% don’t discuss money with their partner on a regular basis. While it can be a tricky subject, it’s important to make sure you’re both on the same page regarding your finances and make money discussions a priority in your relationship.

Mairead explains the emotional side of financial discussions, suggesting, “Sometimes a partner who makes more money believes they should have more say in decisions. Other times, the person who is more anxious or frugal about money gets more say. If this imbalance isn't equalised, both couples can end up with hurt feelings, but talking about money can help us grow closer emotionally.”

How much are rising costs causing strain on relationships?

The cost of living crisis has had an impact on nearly every aspect of our daily lives, and this includes our relationships. In fact, of those surveyed, one-third (34%) say that rising costs and inflation have caused some sort of strain on their relationship. This is down only 1% from our 2023 survey, showing that couples are still feeling the impact a year down the line.

Men are feeling this pressure slightly more than women, with 36% admitting the current financial climate has impacted their relationship, compared with 30% of women.

However, this differs quite significantly across the generations. Two-thirds (60%) of those aged between 25 and 34 say that rising costs and inflation have caused stress between them and their significant other. In comparison, just 19% of the over 55s have felt this impact.

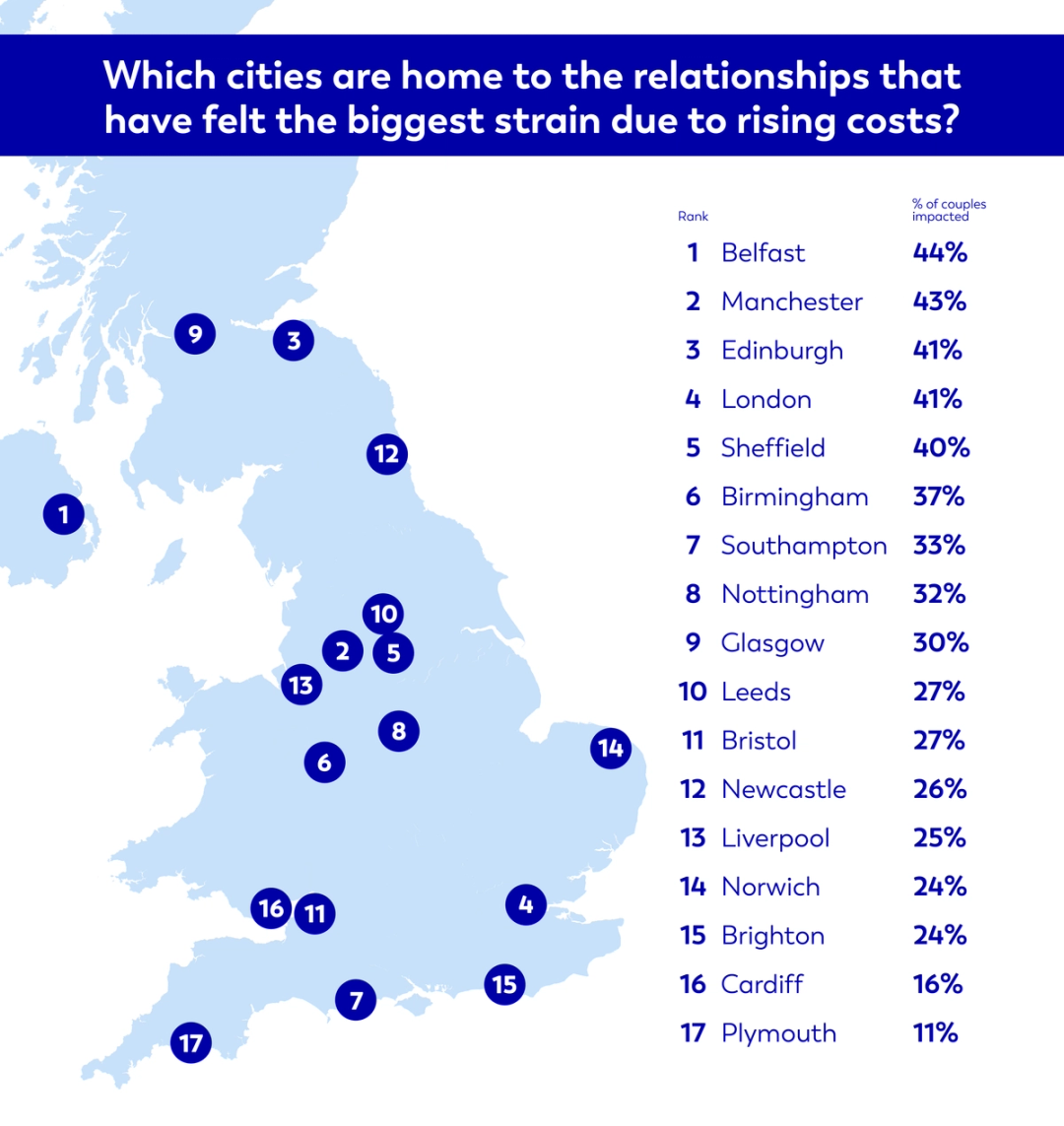

How impacted relationships have been by the cost of living crisis also varies a lot across the UK. Looking at who’s been the least affected, 89% of those living in Plymouth say the current financial climate hasn’t caused any issues in their relationships. Interestingly, Plymouth couples had the exact same response in our 2023 survey.

However, it’s a different story for those living in Sheffield. Nearly double the number of respondents from the northern town admit the financial crisis has caused a strain on their relationship this year, going from just 22% of people in 2023, to 40% in 2024.

Advice for navigating increased costs as a couple

On how couples can navigate the rising pressures, Sharvan Selvam, Commercial Director at Aqua says, “The financial crisis has been challenging for many, but there are some steps you can take to try to ease the impact. First, take a step back and make a plan together. Review your situation and look at where you might be able to cut back on non-essential spending.

“For example, you could save money on your food bill through meal prepping and cutting down on takeaways and meals out. Making simple switches can also help, such as shopping around for a cheaper energy supplier, or finding a better deal for your phone or broadband.

“If you feel like you need guidance on discussing finances with your partner, there are free resources available that can help you navigate this, such as MoneyHelper.org.uk.”

What are the most sensitive financial topics for couples?

We know money can be a tricky subject to bring up, but which financial topics do Brits struggle to discuss with their partners the most?

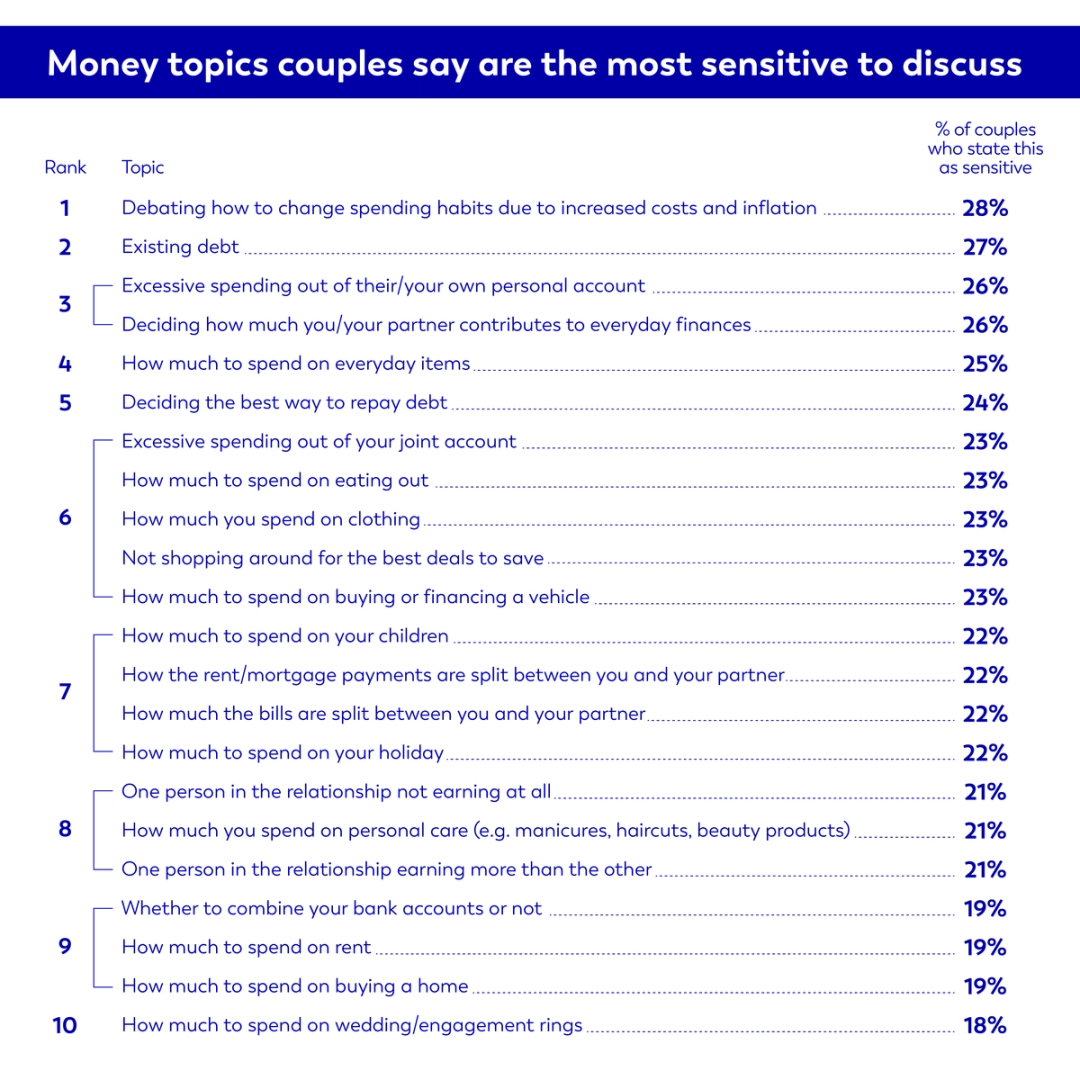

With one in three Brits saying that the current financial climate has impacted their relationship, it makes sense that 28% of respondents say the most sensitive financial topic is how they will change their spending habits due to increased costs and inflation. It might seem daunting, but taking time to review your spending together is the first step to making sure things like rising costs don’t stop you from working toward your financial and relationship goals.

The second most sensitive topic is existing debt, with 27% of those surveyed saying they find this a tricky subject to broach with a partner. Sharvan explains, “Take a look over your debts and prioritise which are the most pressing— try to pay off ones with higher interest rates first. It can also help to include your repayments in a monthly budget, so you know you’re setting aside money on a regular basis. Also, consider striking a balance between paying off your debts and having enough flexibility to live well, so you can still do the things you love as you work toward a healthy financial future with your partner.”

With so many financial topics being difficult for couples to broach, there’s a risk that some couples may be avoiding them altogether. To see whether there are certain topics people are more inclined to avoid talking about, we also asked respondents what spending habits they're most likely to hide from their partner.

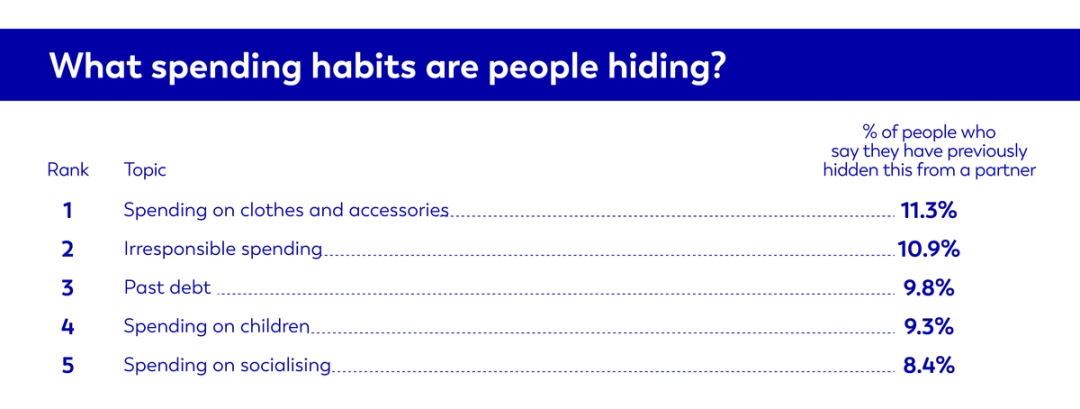

Coming out on top, we found that over one in 10 Brits (11.3%) hide how much they spend on clothes or accessories. This is an improvement on last year, when 21% of people said they hid this kind of spending from their partner.

Following in second, 10.9% of Brits admit to hiding irresponsible spending from their partner, and 9.8% of those surveyed would also hide any past debt — which makes sense given this is one of the most sensitive topics for couples to talk about.

While debt or overspending might seem like challenging topics, it’s important to be honest with a partner about any issues you’re having, so you can both get back on track with your finances.

Mairead explains, “It’s important to make conversations about money a standing, recurring thing. Depending on your relationship and your finances, that could be once a week, once a month, or once a quarter — they can be short or long, as long as they’re regular. Determine the parts of your finances that are important to you and keep an eye out for any financial red flags, such as regular overspending or worries around credit card repayments. If you do see any, make sure to talk about them with your partner.”

How can couples navigate finances together?

According to the survey results, ‘causing friction in the relationship’ continues to be the most common motivating factor behind partners hiding any of these financial situations from each other. With this in mind, Mairead has provided her tips on how best to approach your finances as a couple:

1. Consider whether you want to combine your finances fully

“There are some good reasons not to combine, or at least not fully combine finances. If one of you has significant savings or significant debts, it could very well be worth it to not share bank accounts. If you divorce and your savings are in a joint account, your spouse could get half of them.

“What you could do is keep your own account — but open a joint account for household bills and special projects, such as holidays, house renovations, etc.”

2. Think about having your own account

“It’s a good idea, especially for women, that you keep money in an account that’s yours that you control. Nearly 50% of marriages end, and often the woman sees the biggest impact financially in divorce. So, it’s helpful to have your own investment account, your own emergency account, and your own credit score.”

3. Create a budget depending on earning capacity

“It’s also a good idea to create a shared budget based on both of your incomes, to give you visibility over both of your spending. You can keep a joint account, or a 'we account', in which you can together save money for shared expenses like rent, bills, insurance, taxes and food, as well as large purchases that you’re saving for as a team.”

Top tips for creating a joint budget

As Mairead has explained, creating a joint budget can be really helpful for navigating your finances as a couple, especially if you have shared expenses like housing, bills, or food.

To help with this, Sharvan explains how to create a combined financial plan for you and your partner.

He says, “There isn’t a one-size-fits-all approach to managing your money, but creating a solid financial plan is the first step to taking control of your finances. In the first instance, you need to know the amount of money you’re working with. Figure out exactly how much your shared earnings are, and how much money you will each put toward the joint budget — this might be based on income ratio as opposed to a 50/50 split.

“If you’re living together, you’re more than likely sharing expenses such as rent, bills, and food. Work out exactly how much these are costing you, so you can factor them into your budget as ongoing costs. You might also want to think about the future goals you’re saving towards as a couple. Setting aside small amounts each month can help you build towards these.

“Using a budget planner tool or creating a detailed spreadsheet to finalise your budget can be helpful, as it will give both of you visibility and clarity over your money. Also, try to get into the habit of regularly checking over your budget together, to make sure you’re staying on track with your financial goals.”

Methodology & Sources

A survey was conducted on 1,000 UK consumers (at least 500 of whom were in a relationship or married). Only answers from those in a relationship or who are married were included in the results. The survey was conducted in January 2024.

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

Contributors

Team Aqua

Aqua’s contributors are experts in their field, from a range of backgrounds including banking and lending.

You might also like

Slide 1 of 3

The cost of a first date

Survey finds almost a quarter of single Brits are planning to stop dating due to the cost of living crisis.

Team Aqua

Budgeting for a baby

Discover some top tips for saving for a baby and for your children's future.

Team Aqua

Self care nation

Aqua reveals the self-care priorities of people in the UK.

Team Aqua

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score