Reducing credit card debt

Finding it difficult to clear your card debt? Discover some quick ways that you can start shifting your balance and building towards a healthy financial future.

From car repairs to new clothes for the kids, there are always months where your money just can’t seem to go far enough. A credit card can be a good way of bridging the gap – giving you more financial flexibility and helping build your credit score as you make monthly payments.

But having a rolling credit balance that you’re finding difficult to shift can be frustrating and it doesn’t take much for debt to start building up. Luckily, there are a few quick ways that you can start to build momentum towards shifting that balance and build towards the future.

Make a monthly budget

One of the best ways to reduce your credit card debt is to plan your spending carefully. Making a monthly budget that includes all your incomings and outgoings – from rent and energy bills, to gifts and trips to the cinema – will help you plan what you spend and pay off any debts quicker.

How much money do you have left each month?

The first step is to work out how much you’re spending each month, including any credit card payments. This can also be a great way to spot if you’re overspending on any bills, such as your energy bill, and whether you could save money by switching to another provider.

How much money do you have coming in each month?

The next step is to compare your monthly spending against the amount of money you have coming in. Use the Money Advice Service’s online budget calculator to work this out and get a breakdown of the areas you spend most of your money.

This will tell you how much of your income you need to cover your bills and how much you have left over, which could be used to pay off more of your credit card balance.

Keeping it going

Keeping on top of your finances can be really rewarding and will give you the flexibility to deal with any unexpected expenses and help you save for the future.

Once you’ve started your monthly budget plan, make sure you’re doing a few things each month and you’ll be well on the way to being debt free:

✓ Tick-off bills as you pay them each month, so you know what’s gone out and what’s still to come

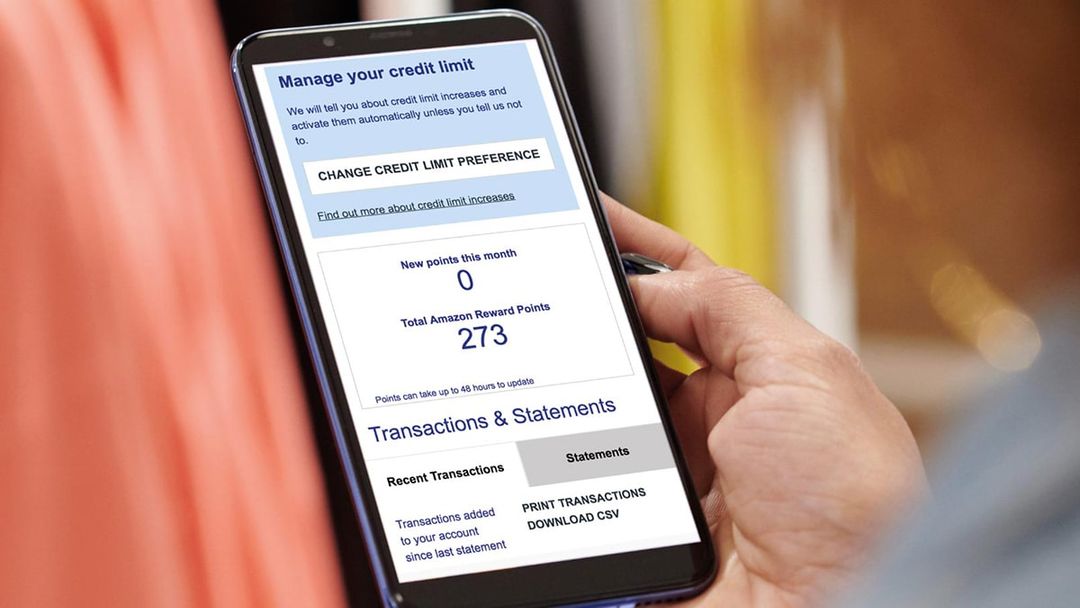

✓ Check your monthly credit card statement to check your balance, payments, and payment due date

✓ Compare utility providers – such as energy and broadband providers – regularly to make sure you’re getting the best deal

Make more than the contractual minimum payment

Paying more than the contractual minimum payment will make a huge difference to how quickly you pay off your balance and how much interest you’ll end up paying – even a few pounds here and there can make a difference.

It’s up to you whether you pay your credit card balance off in full or in part each month but if you pay in full on or before the payment due date, you won’t pay any interest on purchases. We recommend you pay as much as you can afford each month because the more you pay, the more you will avoid paying in interest.

If you want an easy way to work out how much you’re paying in interest, the Money Advice Service’s repayment calculator can help you understand how long it might take to repay any existing credit card debt and the amount of interest you may be charged over this period.

Find out more about payments and contractual minimum payments.

Use a balance transfer to reduce your interest payments

A credit card balance transfer involves transferring the balance of one card to another card. You can also use balance transfers to move balances from multiple cards onto a single card. Many people choose to make a balance transfer in order to save money on interest repayments or consolidate their balances in one place, which can make it easier to stay up to date with their monthly payments.

There are several benefits to making a credit card balance transfer, including:

- Getting a lower interest rate so you can pay less interest on your existing debt

- Making it easier to manage debt by keeping everything in one place

- Giving you the opportunity to take stock and work out all your finances

It’s a good idea to check how much the balance transfer fee is first, as the amount will vary between lenders. If you’re looking for a lower rate, you should also check how your existing rate compares with the card you are transferring to.

The process of making a balance transfer varies from lender to lender but to make a balance transfer with an Aqua card, you just need to call us on 0333 220 2691 and tell us the 16-digit number of the card or cards you wish to transfer a balance from and how much you wish to transfer.

Find out more about balance transfers.

Credit card payments and your credit score

Making credit card payments on time is a great way to build your credit score because it shows that you’re managing your credit well.

Your credit score may improve if you make at least the contractual minimum payment, on time each month, giving you access to a wider range of credit products and lower interest rates.

What if I miss a credit card payment?

If you miss a credit card payment, but you have a good track record of paying off all your credit cards on time in the past, it may be worth getting in touch with your credit card provider to understand what information they give to credit reference agencies Experian and TransUnion.

Unfortunately, making late credit card payments may have an impact on your credit score. It’s likely that you will be charged a late payment fee, which will increase the amount of money you owe.

Setting up a Direct Debit is a great way to make sure you always make your credit card payments by the payment due date. You can set up your Direct Debit for contractual minimum payment, the full balance or a set amount each month (as long as it’s more than the minimum) – whichever you prefer.

Need help with credit card debt?

If you’re worried about debt, there are some free, impartial services that can help you, including:

Failure to make payments on time or to stay within your credit limit means that you will pay additional charges and may make obtaining credit in the future more expensive and difficult.

You might also like

Slide 1 of 3

What is a balance transfer?

A credit card balance transfer is when you transfer the balance from one card, where you might be paying a higher a...

How do credit cards work?

A credit card can be a great financial tool. Learn how they work and how to get the most out of them.

Carrying a credit card balance

Learn what it means to carry a credit card balance and how this could affect your credit score.

The smart way to build better credit

Aqua is the credit card that gives you the power to improve your credit score